Clinton and Obama Helped Make the Democrats a Wall Street Party – Thomas Frank on RAI (7/9)

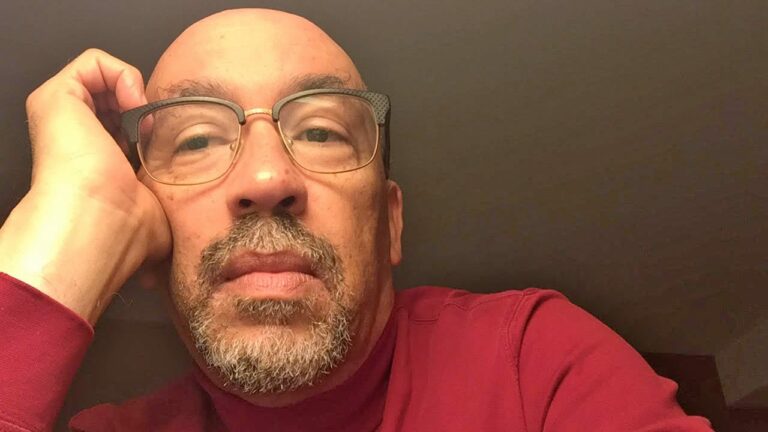

On Reality Asserts Itself, Thomas Frank, author of Listen Liberal, says Democratic Party administrations allowed the big banks to run economic policy and create exploding income inequality – with host Paul Jay. This episode was produced on December 28, 2017.

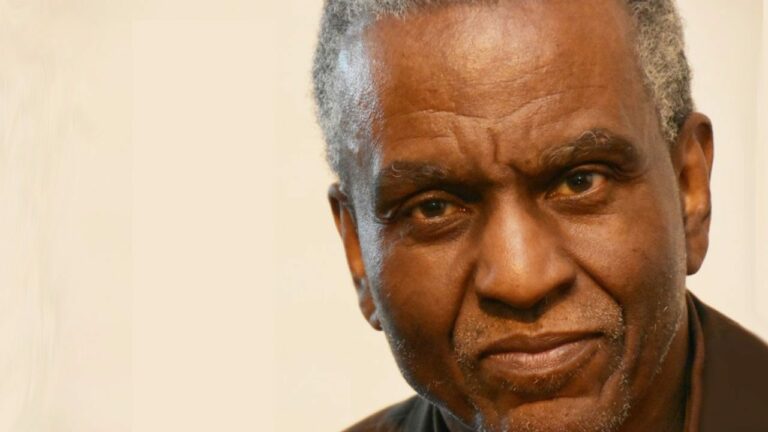

PAUL JAY: Welcome to The Real News Network and welcome to Reality Asserts Itself. Well, at the end of part six of my interview with Thomas Frank, we promised he would be back and we would continue. So here we are, part seven of Reality Asserts Itself with Tom Frank, who now joins us in the studio. Thanks for joining us today.

THOMAS FRANK: It’s my pleasure, Paul.

PAUL JAY: So, one more time. Tom is a political analyst, a historian, a journalist, a columnist for The Guardian, and his recent books, ‘Listen Liberal,’ and before that, the very well-known ‘What’s the Matter with Kansas?’ When we left off, we said we would pick up the Obama years. I guess the question I have is that there is a constant, endless critique — as you mentioned in a couple of your articles — of Trump by the leadership of the Democratic party, and the whole media punditry that surrounds the leadership of the Democratic party. And of course, deservedly so, in terms of Trump. But barely even a reflection on why there’s a Trump; how a climate denier gets elected president; how a Trump gets elected president. If the Clinton years and the Obama years were such a success, why do we have a Trump?

THOMAS FRANK: Oh, man. That’s a big question. That’s a huge question right there, Paul. If you ask the Democratic Party, they’d just, they would … or if you ask the kind of media figures that you were describing, they would just brush it all off and say because voters are bad, or foolish, or something like that. But in fact, it’s a lot more complicated.

One place to start — I mean, a lot of different places you could start in answering this — but before we started the cameras rolling here, you and I were talking very briefly about when Barack Obama first took office in 2009 and what it was like in this country. And I was one of those people who was very enthusiastic about Barack Obama. And he had a situation, you know, he came into office with an economic situation that really should have … the conditions for making him into a Franklin Roosevelt-style hero; one of the greatest, most beloved political figures of all time. All the raw material was there.

The economy had been managed into disaster; managed right over a cliff by the George W. Bush people. Actually, “managed” is the wrong word; the regulatory agencies were asleep at the wheel. They didn’t care what was going on. They were just doing everything they could to allow the banks to hand out liars loans and all the rest of this. All this crazy, crazy stuff had been going on. Here comes Barack Obama. It’s the perfect opportunity. I mean, it’s just like in 1932; very, very similar situation. He has a perfect opportunity to clean up in the way that Franklin Roosevelt did, and to make himself beloved forever.

PAUL JAY: When he was elected, we’d had eight years of the Bush administration, a completely disastrous war, and a crash which-

THOMAS FRANK: And don’t forget Hurricane Katrina, remember that?

PAUL JAY: Katrina.

THOMAS FRANK: And the Jack Abramoff lobbying scandal. The Republican Party and, in fact, the conservative philosophy was an incredibly bad odor back then. And when this happened, when Barack Obama — who, remember, was the unlikeliest candidate of them all. First of all, he’s black, which, we never had a black president before. That used to be regarded as something that was impossible, remember? Then there’s all these other factors. He was from a northern state; he had been born in Hawaii. He was outside of the mainstream in a hundred different ways. He’s also unusually smart, this wonderful orator. He had all of these things. He was a total outlier, politically speaking. To me, he seemed perfect. To me, he seemed like this was the exactly — I thought he was Franklin Roosevelt all over again.

PAUL JAY: Well, he had the moment and he controlled Congress.

THOMAS FRANK: We had the moment, we had the man, is what I thought.

PAUL JAY: And controlled Congress.

THOMAS FRANK: Yeah, and controlled Congress. And I still think that had he played his cards right, we’d be well into Hillary Clinton’s term and there’d be another one yet to come, and they’d still be adding achievement after achievement in the way that the New Deal did in the ’30s. It went on until, when did Truman finally leave office? 1953. But that’s not what happened.

PAUL JAY: I remember lots of articles, predictions that the Republican Party might not get elected to the presidency again for generations, the Bush administration was so discredited.

THOMAS FRANK: Yeah. Well, you know, Obama didn’t play the hand that history dealt him. He didn’t play it exactly right, and the Republicans did play the game very, very well. I mean, the Republicans are always — they’re exceptionally good at the political game. And Barack Obama … I mean, we can go down the list of mistakes that he made, which, if you ask me, are all mistakes of not being forceful enough, not going far enough. But after you’d see the guy making three or four of them in a row, you start saying, “Well, maybe he’s not Franklin Roosevelt. Maybe his heart really isn’t into this project.”

PAUL JAY: Well, he seemed to be really a continuation of Clinton-esque kind of economics and policies. So why don’t we start with-

THOMAS FRANK: I think he was tougher than Clinton, though, but not by a whole lot. But therein lies the … that’s the failure. This is the problem is that Barack Obama inherited from his predecessor, Bill Clinton, inherited a party that had become identified with Wall Street; very, very close to Wall Street. By the way, do you remember in the Podesta emails that got leaked by Wikileaks? Do you remember this? The press covered them in great detail as it had to do with Hillary Clinton’s campaign, her speeches to Goldman Sachs, that sort of thing. But there was an email in there that concerned the ’08 campaign that was much more revealing than some of the later stuff. I don’t know if you know what I’m talking about, but it was an email, sort of round robin email, with a bunch of different participants, and they’re choosing Barack Obama’s cabinet. This is October of 2008-

PAUL JAY: With Goldman Sachs being one of the people who-

THOMAS FRANK: It wasn’t Goldman Sachs; it was Citibank. But they’re going around and choosing — this is before the election, this is in October of 2008, but they’re choosing the cabinet members, and the choices actually were correct; this is actually who later became members of the cabinet. And the guy who’s in charge of the emails is using his Citibank email address.

PAUL JAY: Well, in spite of Bill Clinton’s fidelity to Wall Street and how he helps turn the Democratic Party into a much more fully Wall Street-controlled party, Obama actually raised more money on Wall Street than-

THOMAS FRANK: Yeah, it was amazing.

PAUL JAY: –than the Republicans did.

THOMAS FRANK: Yeah, that’s right.

PAUL JAY: More than Hillary, more than Hillary did.

THOMAS FRANK: He was the first Democrat to do that; to be able to outraise the Republicans.

PAUL JAY: But also outraised Hillary.

THOMAS FRANK: Is that right?

PAUL JAY: On Wall Street, yeah.

THOMAS FRANK: But he outraised the Republicans outright, and he also outraised them on Wall Street, which was a first for a Democrat. And to make a very long story short, he never got tough with them in the way that they needed — what needed to happen never took place. And what I mean “what needed to happen” was he had to come down like a ton of bricks on these guys and on fraud. And when Bernie Sanders says that the, what is it, “the business model of Wall Street is fraud,” it’s an exaggeration, but not much of one. And this was incredibly, painfully obvious after the financial crisis and everybody — and I mean Republicans included — assumed that Barack Obama was going to be the new sheriff who comes in and cleans house. Everybody thought this. Why did they think that? Because that’s what happened last time.

PAUL JAY: Actually, we didn’t think that. Go back and watch The Real News coverage. We didn’t think that.

THOMAS FRANK: You are so cynical, Paul.

PAUL JAY: Well, I wasn’t cynical. I actually read Obama’s speeches. There was just no reason to think it. If you just — he was just wonderful at making such a lovely, smart smile that everyone read into it what they wanted, but he actually never said these things.

THOMAS FRANK: Yeah. Unfortunately, though, that’s what needed to happen, and that’s what people assumed would happen. By the way, Republicans can get tough with bankers, too. Lord knows they did it with George Bush, Sr. when you had the savings and loan debacle back in the 1980s, and they prosecuted thousands of these guys, of bank owners, with his son, George Bush, Jr. I know he’s not really junior, but George W. Bush, actually went after, had to prosecute his own friends at Enron. Remember how close they were to the administration? And that, I think, showed some real adulthood from George W. Bush. This is a president that I really disliked, but you’ve got to hand it to him, he actually went after those guys. Barack Obama didn’t do that.

PAUL JAY: Well, let’s go back and just start with what I think are the more modern roots of Obama politics, which is Clinton in the 90s, where you started having a real undoing of not just what’s left of the New Deal, but also a lot of reforms from the 1960s.

THOMAS FRANK: Yeah. That’s right. Well, Bill Clinton is regarded, and I think correctly so, as a very historical figure of great significance and importance. Now, the historians who love him — and they do, they write these biographies of him about what a great president he was and how he was so health-giving for the Democratic Party and the nation as a whole, and such a wonderful, wonderful president — and they wrote those things right after he was done being president. He doesn’t look so good today, because if you think about the things that he actually got done, they weren’t particularly healthful, and they weren’t particularly Democratic, either. Democratic with an upper case ‘d.’

PAUL JAY: Go through some of the key examples.

THOMAS FRANK: So Bill Clinton had, if you read the biographers who love him, if you read his fans, if you read books by his admirers — not by the people who think he’s a drug dealer and a murderer and all that, but the people who really like him — they’ll always point you to five things that he accomplished as president. Big things; capital-letter things that he got done as president. And if you go back over the list, every single one of them is a Republican thing, a Republican measure.

The first one was NAFTA, which was negotiated by George Bush, Sr. but the Republicans couldn’t get it through Congress, right, because Congress, of course, was controlled by Democrats back then, and Democrats hated NAFTA. Democrats were the party of organized labor. Bill Clinton ended that. Bill Clinton ran a steamroller over those Democrats and got NAFTA passed.

The second one was the crime bill of 1994; mass incarceration. The third one was bank deregulation and telecom deregulation. Fourth one was welfare reform. And the fifth one is a balanced budget. With the exception of that last one – the balanced budget, you could argue that either way – all of these were disasters; all of these, all of these.

PAUL JAY: Especially disasters for African Americans.

THOMAS FRANK: That’s right. And all of them were Republican measures. Welfare reform … I mean, Bill Clinton had said he was going to get it done and he even campaigned on it, but what he eventually signed off on was just terrifying. They did away with … By the way, when you’re talking about the undoing of the New Deal over the years, Reagan had a hand in that; the Bushes had a hand in that. But the guy that undid the biggest New Deal program — and I mean abolished it — was Bill Clinton, and the program was AFDC, otherwise known as welfare, and it had existed since 1935.

By the way, Clinton also wanted to partially privatize Social Security. Social Security is the real prize. This is what conservatives are really after. The day they can finally get rid of that, the most popular government program in America and the foundation of the welfare state, because people love and trust Social Security, therefore they’re open to other programs that you might devise, like say Medicare or something like that. So it’s obviously the thing that’s in the crosshairs, right, Social Security.

And Bill Clinton came far closer than anybody else to doing away with it, to turning the money over into a mandatory retirement savings program and giving it to Wall Street. And in fact would have done it, had it all planned out with Newt Gingrich, who was his … remember, they were supposedly these arch enemies? Do you remember this? But behind the scenes, they actually got along quite well and they had planned the privatization of Social Security and it was basically a done deal, and then the Monica Lewinsky scandal happened, and she literally saved this country from doing away, privatizing Social Security. She’s kind of a hero.

PAUL JAY: And, of course, the Rust Belt gets a heck of a lot rustier during Clinton’s years.

THOMAS FRANK: Yes, and inequality soared. Remember, you had this incredible stock market boom, you had various kind of tax cuts under Bill Clinton, and the balancing the budget. But it was a bubble. The stock market was a bubble in those days, and it was a bubble specifically in the two fields where he had achieved deregulation: the banks and telecoms. And the telecoms went absolutely crazy in the 1990s and so did the bank stocks. Remember, all of the big Wall Street firms went public at this time?

This was the bubble, and it went up and up and up. And I wrote a book during the height of the bubble days. This will bring you way back. It was called, ‘One Market Under God,’ and I wrote this in 1998 and 1999, and I would have CNBC — the stock market channel which was brand new at the time — and I would have that on my TV set in my office blaring all day long, listening to that chatter. They’d interview the CEOs. They had a CEO wealth meter, where they’d be like which CEO is richer than which other CEO today. This is in the ’90s, and it was this incredible, hypnotic, good feelings that were going … Everybody was getting rich, everybody believed in it. And then it all feel apart. 2000, 2001, the bottom came out and the NASDAQ … it went all the way up to 5,000 and then it fell all the way back down to I forget what, like 1500 or something. Just a classic bubble. And that’s not really a good foundation to base your economy on.

PAUL JAY: So then we jump to the Obama years, and you’ve got this moment as you said earlier-

THOMAS FRANK: But … I don’t know where we’re going to go with this conversation, but I want you to remember what I just said about Clinton and the bubble economy because it’s going to come back.

PAUL JAY: Well, so is [crosstalk 00:10:22]

THOMAS FRANK: It’s in a similar situation right now. Well then, you had the housing bubble. That actually got its start in the very late ’90s — Clinton was president — and it had kept going. And the housing bubble, of course, eventually exploded. But what I was referring to is right now with Donald Trump in the White House. But yeah, then you had the housing bubble. It’s funny, bubble after bubble after bubble-

PAUL JAY: And the presidency, an extension of Wall Street; the financial team of the president and Wall Street team [crosstalk 00:10:51], and Obama picks up the same people.

THOMAS FRANK: That’s right. And I’m sorry, I left that piece out of the puzzle. But when you go back and read the books that admire Bill Clinton — as I said, the biographers that are fans of Bill Clinton — that’s one of his great achievements, is that he reunites the Democratic Party and Wall Street. They’ve been enemies ever since Franklin Roosevelt. Actually, they’ve been enemies much longer than that, going back — William Jennings Bryant, Andrew Jackson, Thomas Jefferson; the history of the Democratic Party up until Bill Clinton is a history of hating banks. And here comes Bill Clinton, I mean, right? Jefferson versus Hamilton, right? And here comes … by the way, there’s another story, right? Now the Democratic Party loves Alexander Hamilton. We’ll talk about that some other time. That’ll be conversation 23 or something, okay?

But here’s Bill Clinton. He totally reverses this and his idea is to make the Democratic Party into the party of Wall Street, and he succeeds at this. This is amazing. So, he does it for … well, I don’t know, the reasons that he does it are not that complicated: that’s where the money is. Bill Clinton and the whole Clinton faction of the Democratic Party, the Democratic Leadership Council they were called at the time; they have a different name today. But they believed that Democrats have to match Republicans dollar for dollar in fundraising if they’re going to be competitive in national elections. They have to match them dollar for dollar, and so that’s part of it is reaching out to Wall Street. You have to become … if you’re going to do that, if you’re going to fundraise on that level, you have to become a different party.

PAUL JAY: And they’re totally convinced they cannot fight the Republicans without Wall Street money.

THOMAS FRANK: Right. Or the money of billionaires somewhere else. And there’s also, they love Wall Street because it’s their kind of industry. It’s run by highly educated people. It doesn’t pollute, or it doesn’t appear to pollute. It’s creative. We’re talking about financial innovation in those days. It employs a lot of economists. Look, Larry Summers was Treasury Secretary; these are their people. And you look at the history of all of these Democrats that worked under Bill Clinton and then resurfaced in the Obama administration, and they all spent a certain amount of time on Wall Street at an investment bank or a venture capital firm or something like that. They just spent a little time there, they become millionaires, and then they go back into politics. All of them. Not all of them; there’s some exceptions, but–

PAUL JAY: This is not to suggest the Bush years were in any way unfriendly to Wall Street.

THOMAS FRANK: No, no. That’s right. The Republicans still-

PAUL JAY: They opened up the piggy bank perhaps even more.

THOMAS FRANK: Yes. They had their Goldman Sachs guy. The Democrats have their guy from Goldman Sachs and the Republicans have their guy from Goldman Sachs.

PAUL JAY: But when Obama comes, he is the Wall Street candidate.

THOMAS FRANK: Yeah, well, he didn’t seem like that. He didn’t seem like that and — [crosstalk 00:13:32]

PAUL JAY: He didn’t wear it on his-

THOMAS FRANK: I’m referring to specifically to a famous speech that he gave in ’08 at Cooper Union in New York City.

BARACK OBAMA: A free market was never meant to be a free license to take whatever you can get however you can get it. That’s why we’ve put into place rules of the road, to make competition fair, and open, and honest. We’ve done this not to stifle, but rather to advance prosperity and liberty. As I said at NASDAQ last September, the core of our economic success is the fundamental truth that each American does better when all Americans do better. That the well-being of American business, its capital markets, and its American people are aligned. I think that all of us here today would acknowledge that we’ve lost some of that sense of shared prosperity. Now this loss has not happened by accident. Because of decisions made in board rooms, on trading floors, and in Washington — under a Republican and Democratic administration — we failed to guard against practices that all too often rewarded financial manipulation instead of productivity and sound business practices. We let the special interests put their thumbs on the economic scales. The result has been a distorted market that creates bubbles instead of steady, sustainable growth. A market that favors Wall Street over Main Streets, but ends up hurting both.

THOMAS FRANK: And it was great, where he gave a description of the financial crisis and of what ailed us, and people like me hearing this speech said, “Hey, he’s on our side. He understands. He sees what the errors of deregulation were.”

And by the way, just to … I know what you’re going to say next, so let me throw this out there. Yes, it was Bill Clinton that overturned — not just got Glass-Steagall overturned, but so many other banking rules overturned during the 1990s on the grounds that we didn’t need them anymore, banks could self-regulate, they were inventing these derivatives that would minimize risk; it was so amazing, it was a new economy.

I don’t know if you remember this [crosstalk 00:14:21]

PAUL JAY: The bubble would never end.

THOMAS FRANK: Right, right. But it was because they had computers and they could now devise these financial instruments that were so wonderful.

PAUL JAY: It was in a funny way a version of trickle-down economics. Instead of … the bubble would be so big, everyone would get on the bubble-

THOMAS FRANK: Yeah, everybody’d get a piece of it. Yeah, yeah.

PAUL JAY: Of course, everyone did get a piece of it when it blew up.

THOMAS FRANK: But this is all… So when I wrote that, remember I was telling you about that book that I wrote in the 1990s, the point of comparison, of course, is the 1920s, and people had all the same fantasies and dreams in the 1920s about the stock market as they then recapitulated in the 1990s. I mean, sometimes word for word, saying the same things.

But the idea when you have these incredible bull markets, these bubbles, the idea … it always occurs to everyone simultaneously that this is at Democratic bubble. “This is going to include all of us. Everyone’s going to get rich. It always happens.”

PAUL JAY: And of course, a lot of people do. Their houses start to be more valued, everyone feels that they are sharing in it, except —

THOMAS FRANK: And middle-class people get mutual funds [crosstalk 00:15:24].

PAUL JAY: It isn’t real; it is a bubble. When the bubble bursts, everybody’s house is now under water.

THOMAS FRANK: And they thank God for Social Security again. They’re like, “Oh my God, good thing we didn’t privatize that because then we’d really be screwed.” And they always are very happy then that they didn’t follow through on the belief.

I don’t know. I have elderly parents and I thank God every day for Franklin D. Roosevelt and Social Security because if it wasn’t for that, there’s no stock market in the world that’s going to be …

PAUL JAY: We’re going to do three segments today. We’re going to do the move to a second segment and I hope you’ll join us for it. I wanted to talk about why people voted for Trump and the connection with this, with the inability, reluctance, refusal of the Democratic Party leadership — and to some extent even Bernie Sanders — to critique Obama. Because as I said in the beginning, if the Obama years were such a great success, you don’t get a Trump at the end of that.

So we’ll do another segment. We’re gonna continue with Tom on Reality Asserts Itself. Please don’t forget we’re in our winter fundraising campaign. Every dollar you donate gets matched with a dollar. It’s a very important campaign for us, it funds a lot of our activity and work in 2018, and if you like series like Reality Asserts Itself, it only happens ’cause you donate. So somewhere around this video is a donate button; please click on it if you haven’t already.

Thanks for joining us, and please join us for the next in our series on Reality Asserts Itself.

END

Thomas Carr Frank is an American political analyst, historian, and journalist. He co-founded and edited The Baffler magazine. Frank is the author of the books What’s the Matter with Kansas? and Listen, Liberal, among others. From 2008 to 2010 he wrote “The Tilting Yard”, a column in The Wall Street Journal.