40% of Profits Buys A Lot of Politicians – Costas Lapavitsas on Reality Asserts Itself (pt 6/8)

This interview was originally published on May 28, 2014. Mr. Lapavitsas says that during the financial crisis the power of the state was mobilized to save finance.

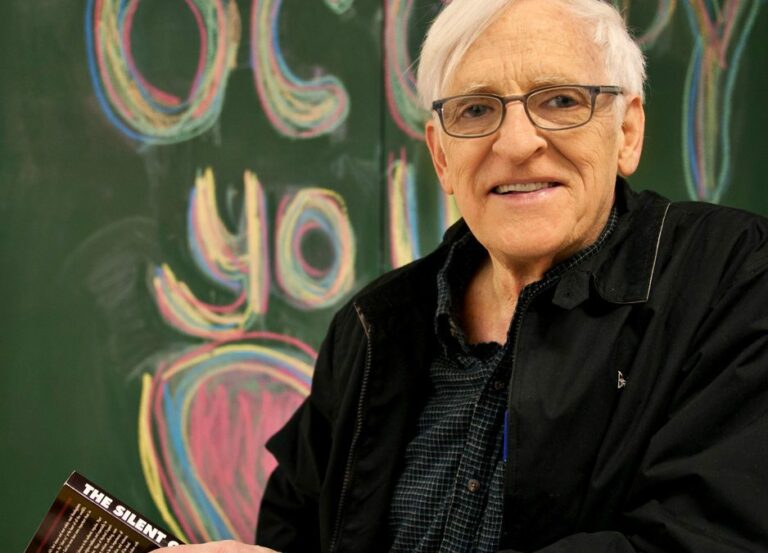

PAUL JAY, SENIOR EDITOR, TRNN: Welcome back to The Real News Network. I’m Paul Jay in Baltimore. And welcome back to Reality Asserts Itself.

We’re talking about finance, the growth of financialization of the economy. And we have earlier pointed out that it wasn’t very long ago–2003 figures–that 40 percent of all profit in the United States was from the finance sector. Now, not 40 percent of everything useful produced came from the finance sector. In fact, as we’ve pointed out, we’re not entirely sure just what useful does get produced by the finance sector. I guess it’s something. Well, ATM machines are convenient. Whatever.

At any rate, we’re going to continue this discussion. This powerful finance sector–what does it mean in terms of politics?

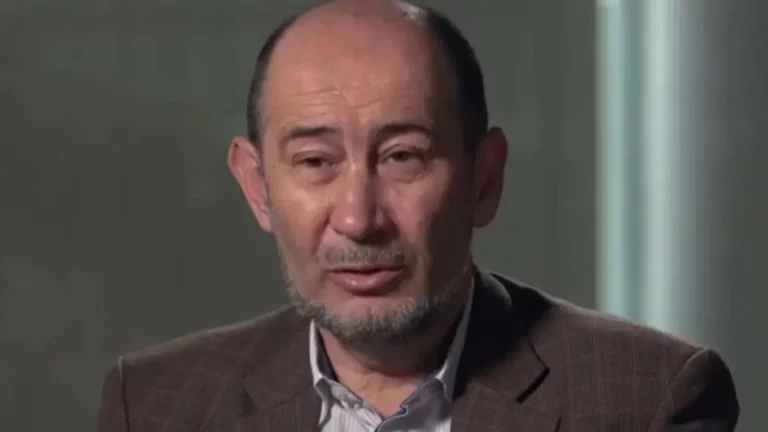

Now joining us again in the studio is Costas Lapavitsas, who’s a professor of economics at the School of Oriental and African Studies, University of London. His most recent book is Profiting without Producing: How Finance Exploits Us All.

Thanks for joining us again.

So let’s pick up the political side of this. Forty percent of all profits, that buys you a lot of politicians.

COSTAS LAPAVITSAS, PROF. ECONOMICS, UNIV. OF LONDON: Actually, it has bought a lot of politicians, I’m sure, in the United States and elsewhere.

I think a good understanding of what financialization has meant for politics and for the role of the state can be gained by looking at the crisis, the recent crisis, out of which we have not come–depends on how you look at it. How did we get out of the crisis in this country and elsewhere? Exclusively, completely through the state, through actions of the state. The power of the state was mobilized to deal with the problem.

And it dealt with the problem first of all by driving interest rates down to zero, practically, the Federal Reserve interest rates. This is the public rate of interest, the public credit of the American people, right? The rate of interest was brought down pretty close to zero–

JAY: For banks.

LAPAVITSAS: –for banks–the rate at which the Federal Reserve lends.

The Federal Reserve also made plenty of liquidity available to banks, vast volumes of liquidity, quantitative easing and so on, available to banks. And that is, again, a public instrument. This is again the collective trust of the American people that is actually mobilized by the Federal Reserve to give liquidity to banks.

And third, the state made available to banks capital, which is basically tax income. That’s basically what it is, because the state has got no other capital to make available to banks, fundamentally.

So in these key ways, the state was mobilized to rescue the financial system and to deal with the crisis.

What did it actually do then?

JAY: Can I just add one point to it is that the banks knew this would happen and they could participate in such high-risk behavior because they know the state’s going to ride to the rescue.

LAPAVITSAS: Let’s discuss that in a bit of detail, because that, again, will tell us much about the politics and so on [incompr.] But let’s first of all say how did the state do it, what was the main aim of the state in dealing with it. Obviously, in the midst of a crisis, there’s a little bit of panic and a little bit of chaos, and that’s the truth, and we mustn’t give to these people more foresight and more knowledge and power than they actually really have, because there are moments of complete chaos, I’m sure, and making it up as you go along, and all you’ve got to do is think of Hank Paulson outside the, you know, Congress and then you’ll have a clear sight of someone who doesn’t quite know what he’s doing.

But nonetheless, the aim of policy in this country and elsewhere was to restore the profitability of the financial system, quite clearly. And they did it. They restored the profitability of the financial system very powerfully. And that’s how banks began to get out of the crisis.

JAY: Now, if you want, if you start from the assumption that the capitalist system is the only real viable system and anything more public and more socialistic is just a pipe dream, did they actually have any choice?

LAPAVITSAS: Oh, they had plenty of choices. But they did not want to take these choices, because (A) there were very powerful sectoral interests from finance forcing them to do that or encouraging and pushing them to do that, the vote that’s bought by means of finance; and second, ideology. And that’s where the politics becomes interesting.

This mechanism of financialization, this system of generating financial profit out of anything and everything that moves, basically, has created a very powerful inequality, and it has provided levers to the rich to make themselves even richer. It’s the most important mechanism for profit extraction in the United States, finance is, even for people who are not directly involved in finance. Even for the CEOs of big non-financial companies, they make a lot of their profits through financial means and financial instruments. So finance has become a mechanism for enrichment, and therefore inequality, across the United States.

Those who make their profits in that way know very well what’s happening, and they use those profits to acquire political power and to acquire influence where it matters to protect the system. There is no doubt at all about this to my mind, and all the good books I read about the policy process in the United States and elsewhere confirm it.

So even if they had options (and, as I would say, they did have options), there were very powerful forces in play.

JAY: And you even get to a point which, you could say, unlike the 1930s, where an FDR was able to assert, you could say, the overall class interests of capital, to not let the finance sector wreck the system for everyone, there’s no mitigation at all now. They can’t pass the most measly regulation on finance. Nobody gets prosecuted for things that are clearly fraudulent.

LAPAVITSAS: Yes, quite clearly the case. And that’s because of the–I mean, I don’t have a full explanation, obviously, and we need more work on this, people to tell us exactly how it happens, but clearly there is a sectional, sectoral, and very strong class interests involved which are out to protect their privileges, and there’s no doubt at all about it. And protect their privileges they did, because what happened in 2009 already is that financial profit begins to bounce back, and by 2010, 2011, it’s a very high proportion of total profits. Again they did it. They basically did it. And they were very successful at it. They made sure that the American people and people in other countries, other countries that suffered similar problems, took the pain and subsidized the financial system to allow it to make big profits again.

And the other thing they did was to mobilize their interests, their power in the policy-making process, their class interest, to preclude serious structural change, to preclude serious regulatory change. There’s a lot of talk about these things, a lot of waffle, basically, but fundamentally there’s been no serious regulatory structural change with teeth, you know, that would actually transform the system. That they did very clearly. And in a sense, you saw during that period the naked class interests involved in financialization that know what they’re about and they’re out to defend [crosstalk]

JAY: And it’s partly the Fed enabled this, because the Fed found a way to throw money at the banks and make them look solvent, hide how toxic all their assets were with all the way the Fed gave these zero-interest loans, used quantitative easing to make the banks’ books look good, and through a kind of smoke-and-mirrors they made the system look stable when it kind of really wasn’t, which makes people think, well, maybe we don’t need all this regulation anyway.

LAPAVITSAS: Yeah. I mean, that’s pretty much what it is. I mean, the Fed intervened, used all these essentially public tools, partly to cover the weaknesses of the system, partly, though, to assuage the system in a real way, because they did–.

JAY: Oh, if they hadn’t it would have unraveled completely.

LAPAVITSAS: Yes. They did actually allow them to begin to make profits again, American banks. And it’s not–.

JAY: It’s not that ordinary people wouldn’t have suffered. If they–as we say, if you preclude the interest of some kind of banking system, then to some extent they had to do this, ’cause the whole thing would have blown up in their face.

LAPAVITSAS: If you are not prepared to nationalize banks and to go for a public banking–and, actually, it was discussed at the time. It was discussed by very powerful people in the United States. But if you preclude that, if the banking interest and the financial interest uses its power to preclude serious discussion–

JAY: Which is what they did.

LAPAVITSAS: –which is what they did, then, yeah, obviously, you maintain you know what you did and you end up with financialization continuing, because that’s what’s happening.

The other thing we’ve got to factor in, though, to understand this is, of course, ideology. Ideology is very, very important in this. It isn’t just interest. Interest is very clear: anybody who is honest about it will recognize the naked class interest of finance and what [incompr.] and of–all he people who enriched themselves through finance were very keen to maintain the system, and there’s plenty of them with a lot of power.

The other thing that we must factor is ideology, of course. And the dominant economic ideology of financialization period is of course what we call neoliberalism, the idea that you deregulate, you liberalize, you free the market, and the bottom line is the market is good and the state is bad.

JAY: And the market will always in the end find equilibrium, and capitalism will always bounce back.

LAPAVITSAS: That’s it. And this ideology is very, very powerful, and in the United States it’s exceptionally powerful compared to other countries. A very powerful ideology. And that is–you find it in the policy-making field. You find it in the academic departments. You find it in think tanks. There’s a vast array of institutions and mechanisms across the United States and elsewhere that produce and reproduce this kind of thinking and this kind of approach to the economy and society.

Now, I don’t want to go into a deep debate of it. I think it’s a great lot of nonsense, if you really want to go into the substance of it. What I want to stress is something else. This image they present of we are for the market and the free interaction of agents because that produces the best results, and the state is problematic, and we are against the state and we want to limit the state because that’s the way to get progress and welfare and so on, this is actually not true in terms of what they want, in terms of committed, sophisticated neoliberals truly want. And that became very clear over the last two years. These people understand very well what the role of the state is, and they know that the state isn’t really an enemy of financialization or an enemy of free-market capitalism or anything like that. Actually, it’s the tool you need in order to put all these policies in place. And neoliberals have a clear aim and a clear strategy to capture the state. There’s no doubt at all about it.

So there’s been a neoliberal capture of the state and a sort of–it’s almost like self-censorship or self-limitation of thought and options within the ruling elite, within the ruling class about what might be feasible. And anything that goes outside the neoliberal box is not even considered.

JAY: Well, ’cause everything that goes outside that box leads to challenging private ownership and finance, and that’s off the table.

LAPAVITSAS: That’s it.

JAY: Okay. Please join us for the next segment of our interview on Reality Asserts Itself on The Real News Network.

“Costas Lapavitsas is a professor of economics at the School of Oriental and African Studies, University of London and was elected as a member of the Hellenic Parliament for the left-wing Syriza party in the January 2015 general election. He subsequently defected to the Popular Unity in August 2015.”