Thomas Ferguson: Big Business Takes Cash as Workers Laid Off, States and Cities Go Bust

Democrats and Republicans fostered an environment with little accountability for finance and big corporations, says Thomas Ferguson on theAnalysis.news podcast with Paul Jay

Podcast: Play in new window | Download

Transcript

Tom Ferguson Podcast Interview for TheAnalysis.news

Paul Jay: Hi, I’m Paul Jay, and welcome to the analysis podcast.

Most economists believe we are heading into a deep global depression. Will the economic stimulus packages that are being announced, particularly the American one, which is the largest, deal with the depth of the crisis? Now joining me to talk about this is Tom Ferguson. Tom is a professor emeritus at the University of Massachusetts, Boston. Thanks for joining us Tom.

Tom Ferguson: Hi. Thanks for having me. Look, the question here can be answered very straightforwardly. How big is the decline? And, not just in the US, but in Europe and the rest of the world? And the answer is, first of all, of course, that nobody knows. But secondly, that they’re much deeper than most people anticipated as this sort of crisis really got rolling in, for example, in March.

Yet, if you take a country, area by area, you get a much better sort of feel for what’s going on, and how you can indeed be sliding into something like the scale of the Great Depression. I mean, in the US you have watched unemployment soar. It must be something like 20%. Now it’s going to keep going.

The US did, on the face of it, if you figured you need maybe a package equivalent to 10% of the GDP, to try to offset that – that’s with some qualifications we can come back to. They only did it, as usual, about half that size in the end. I think the best analysis of the US package is Lance Taylor’s for INET – it’s on the website there. Lance Taylor spells out those numbers. The fundamental thing is that there’s, you know, a fair amount, maybe at the time, it seemed about five to six percent of GDP, might be being handed out in direct relief. That included the small business support program, which people quite mistakenly, took at its word, that it would support small business.

We know now for sure, that it has been perverted by a string of things. Probably the intent of the treasury to begin with, but also the way it was handed out through banks, there’s no doubt at all. You got good reporting by the intercept and the New York Times, on how the loan process has been abused and gone to large numbers of the rich. And so…

Paul Jay: Lee Fang points out in The Intercept, specifically, good friends of Donald Trump, and he gives a bunch of examples in a recent article.

Tom Ferguson: I wouldn’t dispute that. Though, Trump’s got a lot of friends, and so it’s like… I always have problems with this type of inference. Until we can sort of see what the whole thing looks like, which we can’t do.

Now we may add, that’s not an accident. Both the Democratic and the Republican leadership completely decided on this to go for broke. That is to say, hide in the dark. They took the old laws that were put up on regulation and reporting, for 2008 and 9, and made those even weaker and that’s quite deliberate. In that sense, we’re talking more money with even less accountability. And it’s not a single party. It’s just not the Republican party alone, on this. I mean, that bill is just ridiculous in that stuff, and I’m hardly alone in that.

Let me come back to the sort of main thread. So here’s where I come out. Let me just characterize it in qualitative terms. We’ve thrown a lot of money at the problem, and that made a lot of people think the population as a whole was going to be substantially helped. It’s clear that there is some aid in there for people, but probably not nearly enough.

And instead what you’ve got is, most of the cash has gone to business. The point of that aid to business was supposed to be to keep people employed. I think it is clear. Just look at the unemployment rate. That’s the simplest thing to do here is that in fact, what they’re doing, is taking the money and mostly not employing, continuing to employ people. There are exceptions. I’m not trying to deny this, but the evidence I think is pretty clear. You get a very odd way of looking at this is because a good deal of that package had to do with the treasury providing money to absorb losses that the federal reserve would take when it would set up special purpose vehicles. Just read it as an accounting device, if you like. It’s still the Fed – to hand out money for particular financial sector participants. Well, the commercial paper facility, everybody’s talking about how little has been used. Well, that’s telling you something. Commercial paper you usually use to finance something you’re actually producing: payroll or raw materials or something. And the conclusion, when you look at this, I think you see pretty clearly what’s actually happening is, the businesses are taking the cash, but they are just as fast and rapidly laying people off. In that sense, we’re going to have a real problem here because you haven’t gotten enough relief cash. A direct relief would have been much better. Way more money, direct relief, and then people could buy what they needed. You can aid the businesses that way. That’s not the way we do business in America, as you know. And so, we are sort of digging ourselves into a hole here. Not just here, but elsewhere, in the UK, in Europe, all of these sorts of business-directive problems, all show this type of problem, where there’s not enough direct relief. Now in due course, you know, that’s going to put people in really nasty positions. They can’t eat. Or they have to work in that sense. You’re going to fuel some of the protests that you’ve already seen for “we must go back to work.”

That’s abetted by a large propaganda campaign that has been very clear from the very earliest days of this crisis on a multinational basis. We talk about that in a minute. But let me finish the thought here. We are creating a situation in the next month or two, six weeks or so, where you’re going to see the lack of aid is going to hit a lot of people, and it’s almost a parody of what the Democratic Party has often done in the past. I understand the Democrats are not solely responsible or even principally responsible for this bill, though they did control the house and I don’t think they tried very hard.

You’re setting up a deadly situation where the Democratic Party claims the leadership. Pelosi and Schumer are claiming, they’re standing up for us to Americans. They are not standing up effectively for most Americans. And, of course the Republicans have no interest in that. This is going to get sticky, as the true minimal smaller sizes of the aid packages sink in. That’s just by start.

There’s another point to bring out here, which I can hardly believe this, but they did it. That is to say, the house Democrats did not stand up on a key point, which is, it’s just obvious that state employees at every level, are pretty vital in dealing with these coronavirus panics. Even simple things like police, fire, and things like that, you’ve got to keep functioning.

Now the States are taking huge revenue losses, just like the businesses are. They’re losing on their taxes. Now the aid bills put money indirectly for Coronavirus expenses that States incurred, but they didn’t give them any kind of an offset for the lost tax revenue. Now that’s insane. Now, what I do not understand, I’m not the only person who cannot understand it, is why Pelosi and Schumer ever accepted this and did not make a public issue out of it.

I mean, they kept saying, we’ll do it in a later bill. I heard that story before the big package passed and I knew at the time I was talking to people down there. A lot of people thought there might not even be another bill. They were wrong about that. That thing is, is past. But the point is that you’re letting your state systems rot out here. There are people actually getting laid off and things like that. And also at the local level, the problem hits not just States, but localities. I mean, how crazy is this? And not, you could say, well, the Democrats didn’t have the strength to force the issue in the conference committees between the house and the Senate.

You know that? No, nobody even tried very hard. Obama did the same thing back in 2012 when they, again, didn’t fund state funding. Democrats have a long history of this. The only sense I can make of this is that they like to encourage the state and local employees to just go out and vote saying, if you don’t do it, you’ll be blown away.

But I don’t for a second believe that they couldn’t have done better than they did if they had tried to. It’s pretty simple. The business demand for relief at that point was very intense. You know, when the conservative Senate Republicans momentarily held the bill, there was a literal stock market meltdown.

The Democrats should have just said, look, we’re offering, this will go along with some kind of relief, but we want that they’re going to have to do it for the States and localities too. They didn’t. I think it’s a huge, abuse, frankly. It’s just ridiculous.

Paul Jay: Let’s return to your first point. It seems to me then that what’s beginning and we’re entering into is a kind of death spiral. You get a situation where there’s less and less, dramatically less, consumer demand. And loaning money to these businesses, especially when they’re using it just to deal with already existing debt, some of which, a lot of which, was incurred just to do stock buybacks and other kinds of non-productive and parasitical investment.

So you get a situation where they’re trying to get the economy going again, but you need consumers to buy stuff, to get the economy going again. So, one, millions of people will still be out of work and not be able to buy stuff, and they’re not doing anywhere nearly enough to, as you said, indirect subsidies so people can buy stuff.

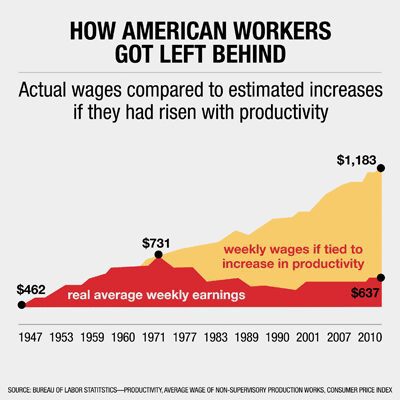

But, but the other thing that’s gonna happen as people do go back to work, the pressure of so many unemployed people, especially in the non-unionized sector, they’re going to go back to jobs at lower wages, which means even less consumptive power, purchasing power. And if that keeps going, don’t we then get into what we saw in the ’30s: a long-sustained depression? Roosevelt even talked about this, that loaning money to businesses doesn’t do it.

Tom Ferguson: I don’t disagree. Let’s try working this through sort of piece by piece. At the time the COVID-19 thing hit the US was actually at a relatively high rate of employment. I mean, unemployment had sunk two levels, you know, not seen actually in a generation. And you know, it had blown past all these benchmarks that it was not supposed to be able to do.

I mean, people were still coming out of the woodwork, taking job. And you know, then the COVID hits and of course, exactly as you just suggested, it’s running the unemployment rate way up. Now that is going to hit the general wage level also, as you suggest. That’s the first thing there.

Yeah. And it’s going to drop wages in general. On the other hand, there are going to be some offsets. You can be sure that food workers, workers directly in the production of food and some transportation in some places and things, are absolutely essential. Like, you know, in other words, public transit in cities. The folks who actually get food from farms to your supermarket. Those jobs are all much more dangerous than they were. And you’re actually seeing a pretty interesting development that gets no publicity.

There’s something like 120 wildcat strikes that people have recognized. The place to look is Mike L’s payday website, where he’s been trying to tabulate them. And you’ve got quite a resistance to people just getting killed. And the whole discussion of going back to work is more than a little perverse.

Let me just sketch this cause it’s, it’s extremely interesting. From the very earliest moments as the COVID virus hit, actually, when it hit first in Italy, you had European industrialists openly saying, you know, we really can’t shut our economies down. That would be ruinous. There was one German economist who was walking around saying, you know, if we had to do this for more than three months, it would be the end of everything, etcetera. Those views were very popular all over in business communities everywhere. Were, or they were most popular though. And where are they got almost unchecked sway was in the most laissez-faire economies, which means, you know, the UK and the US, bluntly.

And the US and the UK were very slow to move. Now when the Imperial college estimate of deaths was published and hit both the US and the UK, with the sort of force of a thunderclap and the UK gradually changed policy. And so the US has been very haltingly doing it. Now what you actually have here is, bluntly, a bunch of white-collar people largely advising blue-collar people to go back to work, as a white-collar guys can mostly work at home. Not everybody can. You know, there are obvious exceptions to that, but the general rule is pretty clear. Then you have some important sectoral differences. You could see, for example, the whole medical community in both the US, UK and elsewhere really upset about this. You know, they had to deal with all these sick people and they weren’t prepared to deal with it either. But their interest in sort of like actually getting, what would actually work to slow this, cause just absolutely threatening to overwhelm hospitals and the whole medical complexes of every country, for a while.

There were some pretty strong pushback on that, and there still is. And you can see this breaking down. It’s going, you know, the more laissez-faire types and most countries want to open immediately or sooner, at least in part, that’s true in Austria, it’s, there’ve been a lot of voices in Germany.

So we get to the US and, you know, you’ve seen all this played out in which, you get, in effect Republican leaders saying, let’s go back to work now. And Democrats a good deal more cautious about it.

Paul Jay: So Tom, one of the big issues in terms of getting economies going and people back to work is how are health authorities going to know who’s sick and who isn’t? And one of the things being talked about is some kind of contact tracing system. So how effective is that? What are the problems with that?

Tom Ferguson: Well, Paul, there, there are actually a couple of ways people suggested, besides slightly trying to restructure the way, for instance, you go into a shop with numbers of people – stuff that’s specific to this enterprise.

One of them is a lot of testing, either for antibodies or tests to see that, in other words, that you had the disease or whether you have it now. The difficulty with those tests is that all of them seem to have many false positives and false negatives. That leads very quickly to the question, okay, what are you going to do if you’ve got people wandering around that you haven’t caught. Your tests, haven’t shown they have the disease, but they have it, or you know, you’ve got people you claim they have the disease who don’t. Nobody has a really good answer to that question. But the suggestion has been so-called contact tracing for people who’ve been proven to have actually caught the disease.

The suggestion is, use a cell phone to do it. And the cell phone schemes come in two varieties. One is highly centralized, where effectively you are putting an app on your cell phone, which keeps a record of everything and everybody that you came into contact with. A lot of that stuff works through Bluetooth, so that’s not the only way to do it.

The other system is not centralized and deliberately anonymized. So you can’t tell who or what. Nobody can get a bird’s eye view of everybody you come into contact with. Instead, your app would send a message to everybody that you came into contact with, that you had been found to have the disease, that would warm them.

Now, Google and Apple have collaborated to design that decentralized system. There were a variety of schemes for centralized systems. Australia is implementing one right now. The UK, Norway, and France are all going for centralized systems. Germany, Italy, and other countries are opting for de-centralized.

Now, the issue here is privacy. Whether you’re going to have any at all. And it’s just a basic that if somebody has a centralized record of everything, everybody you met, every place you went. Well, who’s who’s gonna control that? Now the control issue has two aspects. One is the very simple one is who’s going to track you?

But the other is, once they’ve got you like that, you could, for instance, turn this into a vast amount of useful medical data, or other data. And so the question of the ownership of that data is huge. It’s perfectly obvious that while governments are talking about, well, maybe they’ll control it or something, that companies are hoping to control it, the ones with the centralized systems.

This is an issue that’s gonna get very sticky very fast. It’s already happening, as I mentioned. There is a final aspect of this too, which is never mind whether you are willing to put an app on your phone that would track you, your employer may require it, and this is clearly an issue that’s coming up like a full moon with major applications, cause if people are being told they can only go to work with a highly centralized system that can track them and then obviously the employer there, no question. Who’s going to have access to that data? This is clearly going to be the end of a lot of privacy as we have ever known it.

It is likely, I think, a near certainty, it’ll be abused. Small questions about worker organization or even just the simple problem of do you have to answer the phone at four in the morning if your employer calls you or something like that? It’s all going to have to be redone. This is really big stuff and it’s very, very important.

Paul Jay: Is there an alternative?

Tom Ferguson: Well, the decentralized systems would at least preserve you from any single person knowing or any single place concentrating all that information, cause it’s not stored anywhere but on your own phone and the Google and Apple system. So yeah, there are alternatives here, including a lot of people are probably just not going to do it. The question is how much coercion do you want? We’ll find out.

But what I’m trying to tell you is this, is that the reopening story is a mess. That the technical prerequisites for that don’t really exist. Nor have we dealt with the safety issues. Let’s say the net, the net effects of doing all of this badly mean the health risks are real.

Now, what I cannot fathom is why the American unions have been so quiet on this. You know this, as we are doing this podcast, the news shows a French union won a judgment to tell Amazon, it’s absolutely got to do better on worker safety. Now Amazon’s responding more than it’s been trying on worker safety. I don’t know the particulars of this, so I’m not going to try to pick a favorite there, but it’s obvious that in the US you know, with all these wildcat strikes and other complaints that are surfacing, you’ve got a serious problem with workers’ safety and the, the environmental protection agency is just missing an action.

But, frankly, as far as I can tell, so is most of organized labor. I don’t understand why they’re not running a complaint center if you’d like, or at least some union. Some unions have been active. The nursing unions, for example, who are right on the front line, are active. I also, frankly, can’t understand, there was a case of, I think his name was Minlin, he was the first physician fired when he complained. That is, people were not prepared. That they didn’t have protective equipment. He was fired by a hospital. It was owned by a private equity company

Paul Jay: This is in Washington state, I think.

Tom Ferguson: Yes, yes. And that should have led immediately to demands for whistleblower protections in the law. That should have been in the second stimulus bill that just passed. Nobody put this up. The passivity on the part of… I mean, I don’t expect the Republican party to be very interested in this. But frankly, I would have expected the Democrats to be a little more interested, with a little more public nudging from labor. I don’t get it.

Paul Jay: Tom, let’s go back to the beginning again. If the issue of the care package is that most of that benefit is going to go to big business and not that much to actually ordinary working families in terms of boosting consumption, what should be done? For just out of the ridiculous hypothesis that you got a phone call from the White House and whether it’s this one or if it’s a Biden one, what should they be doing? What does that look like?

Tom Ferguson: Okay. What I would do is pretty much in every country what they should… I mean, I would say there’s nothing special about the US here. You need to support the average person’s income. I would just do it directly. I mean, it’s a little embarrassing that the Indian government, which you’d think of a developing country, and a not too developed country in many respects, they got money to nearly their whole population in just two or three days. They’re using electronic means.

The unemployment money in the US is obviously only coming up very slowly. Some states still don’t have, apparently, the system fully working. This is admittedly a problem in part that has been years building because you starve the state sector. Both Democrats and Republicans just didn’t care much about that, but it’s obvious, especially Republicans.

And so, I mean, they’re using very old computer systems, but I would try to get money directly to people, but you actually can’t just solve this problem by handing out cash. You have a genuine production problem in that sense. The people who said at the start that you really needed a kind of World War II model… You didn’t need to put the whole thing on a war footing, I think, but you do need to organize production. Trump was criticized quite correctly for being very slow on using the defense production act. It’s just ridiculous. If you look across the world, you can see that virtually every country when it faced the decision of what to do, did two things.

One is they said, we’re not going to try to organize production. We’re going to just stick with whatever system we’ve got. And then, we’re going to hand out most of that money through business. Both of those decisions contained important elements of mistake. I understand, you don’t want to turn the whole economy upside down.

You don’t need to have the state running all of American production, but it’s insane to have, for example, the States bidding against each other for medical supplies that are in short supply. They should have on day one told general motors and the other companies you’re gonna make, you know, whatever you need, respirators… I mean, this couldn’t have been much better organized. You can see how crazy this whole system is if you look at the mask question, where we were all being told for well, months, literally, right? Yeah, you don’t need masks. They won’t do anything for you. It’s perfectly obvious. Now, I think, there was a lot of research on this. I’ve seen it. Masks do help. Even homemade masks work

I’ve had a lot of hopes that the healthcare industry would have a strong incentive to tell the truth and they were clearly doing that as the plague descended. There were lots and lots of healthcare workers getting sick. And in that sense, it didn’t matter if somebody upstairs and some corporation wanted everybody back to work.

The healthcare people had to sort of tell people, “no, you can’t do that.” I think that’s to some extent still true. It’s a little more troubling though, as the folks in the front lines – and this is still not true everywhere – but where they have learned to protect themselves, they finally got masks, for example, and gowns, and things like that. When they start restructuring these systems, as they often do, instead of turning the whole hospital over to the coronavirus, they instead segregate it in an infectious disease ward. Then it’s not so clear that folks have every incentive to be blunt about the real risks. I mean, put simply, you can see hospitals beginning to complain that they can’t do elective surgery, which is where they make most of their money. And it may be that some of these folks will be tempted. I’m sort of somebody who thinks that a lot of large-scale businesses, which certainly includes healthcare, couldn’t resist anything but temptation. This has to be watched closely in the future as this develops.

Paul Jay: I saw some doctors had done a study looking at what is it that’s in common between countries like Taiwan and then in Hong Kong and in Singapore. What is it in the countries that had done relatively well, and the common factor was, everybody wore masks because even if wearing a mask, as they say, protects others from you, if everyone does it, then everyone’s getting protected from everyone else.

Tom Ferguson: No, I get it. Yeah. I mean, it’s a public good, as they would say, in economics. Yeah. But that should have been organized. You know, [Governor] Cuomo jumped, I think, into considerable acclaim when he decided the state was going to try to commission – it was actually using prison labor, I think – to make some masks. The federal government should have taken that over on day one. It didn’t. The US and the UK have both been super slow on this. Again, these are the centers where what you might call the average free enterprise sentiment in the business community is higher probably than anywhere.

And they have both done pretty badly on this stuff. It’s pathetic and ridiculous. This is also gonna have to happen. As this crisis goes on, I’m assuming there won’t be a quick cure or found. There will be a cure, one hopes, but not for a while. You will have to organize some food production and things like that.

Otherwise you get these shortage economies, where folks are moving into positions to take advantage of that, sometimes with increasing monopoly power, which is something that happens in a lot of cases like this and I think it is happening again. You know, everybody’s favorite example of the toilet paper shortage. How come it’s so short? What’s up here? Or you know, you’ve got people pouring milk out, when people are looking for milk. What’s, what’s up here? That kind of stuff. This is not a case where looking for the price level to fix the problem is going to work. It’s failing, and it may be, in some cases, market manipulation. You’re going to have to organize that and you probably need some windfall profits taxes too.

Paul Jay: If we look, if we look at this, these two factors, science professionals are saying, do not go back to work too soon. This pressure to get everyone in the economy going again and all of this. If you follow that, there needs to be a lot more money in terms of subsidizing people to be able to buy food, or we’re going to be looking at starvation. There’s already millions of people that have never dreamt of being in poverty are now quickly in poverty. 30, 40% of the country was living paycheck to paycheck and now there’s really no paychecks for many of them. So you put that together: the science and the need for income. How much subsidy can the feds do? How much debt can be incurred, number one? And why, if they do need to keep subsidizing, there’s still no talk about taxation? It’s not like America doesn’t have enough wealth to keep subsidizing. They just don’t want to tax it away from the people that have it.

Tom Ferguson: Look, you know, very well, just as I do, why no one is talking about taxation. It’s because the people with all the cash are recycling parts of that money right into the political system. I mean, I don’t want to be a bore, I was doing political money before it was fashionable, and I don’t doubt that I’ll be doing it after it’s fashionable.

It’s just amazing to me. I listened yesterday to a couple of technology guys talking about how we would have to have new ideas, to change our economy. No, we have a political money stranglehold on US policy-making apparatus. We have it in Congress. We have it in the executive branch. It’s even hit the court system via the nomination processes, and of course in state courts, where you actually run for office, you’ve got to raise the money. I’ve written about this a million times, sometimes with my colleagues, Paul Jorgensen and Ji Chen. That’s why nobody is talking taxes. The US government is paralyzed as it is, because political money runs the place, not voters.

Now, let me though, pick up on this theme of what do we do to get out of a big depression. It’s a really deadly situation here because the US policy response is inadequate, just in sheer quantitative terms. Not least because the small business money, so much of it was allowed to go right off to the big business, but it’s inadequate, but it’s bigger than most countries. If that resembles what happened in the US after 2009 and 10, that’s because that’s what happened then too. In Europe, the size of the stimulus, except for Germany, is really very small and the European Union can’t get its act together on much of anything. It’s just a macroeconomic nullity, except for its central bank, which is at least, at the moment, giving countries easy money.

In sharp contrast, in 2009 and 10, you know, China did a big program of expansion that helped carry the rest of the world through that. I mean, you had a mild expansion in the US and a big one in China, and that was pretty cooperatively worked out. I don’t mean that people sat there and said, okay, you do this, and I’ll do that.

Although in fact, they had G-20 meetings and things where they did say things like that. But that whole process of international economic cooperation is broken down completely. The sort of breakdown of the international political economy, the sort of increasing rancor between the US and China, but also between the US and Europe is very strong.

So you don’t have anything like a coordinated approach. Now, the reason this matters is that, first of all, if you want full employment in a big country like the US, unless you’re prepared to do it all by yourself, which nobody is. Frankly, it couldn’t be done even if they wanted to, nevermind, America first or something like that. They’re not in fact doing anything like that. And the US is less dependent on international flows of goods than most countries, but it’s still heavily dependent on them. You need to get back to something like world full employment. It’s not possible to have the US prosper and say Europe or China go completely collapsed. It’s not going to happen. That’s the world’s not like that.

Paul Jay: But is it possible? Is it possible? It’s going to be the other way, and could China be China again, and even more so, given that they seem to have controlled the virus more than the United States has? Is China going to be the locus of the world economy?

Tom Ferguson: No. The demonization of China in the US is pretty ridiculous. That said, there’s plenty of problems with the Chinese regime. But more than that, I think there has been a systematic overestimation of its economic strength. I mean, this is a contentious item, but I basically think when you look at the full flow of international patents and things like that, the notion that China is coming to take over the world is not plausible at all.

Paul Jay: Tom, give me a second here. Is it possible that this will put enormous pressure on China? There’s already been some, but much more, to raise the level of wages in China so that the Chinese market can consume more and not be so dependent on the American market. I know this doesn’t happen overnight. They certainly have a population big enough to do it, if they’re willing to democratize the economics and have less Chinese billionaires. This is obviously some of the same issues as there are here, but they have the potential to do it. And if Chinese purchasing power goes up significantly, and is much more reliant on their domestic market, then doesn’t that change the geopolitics?

Tom Ferguson: Well, it would change it if they are. It depends on how much you think they’re actually doing. I read the belt and road initiative as fundamentally an older economy model, meaning the, that is in effect an effort by, bluntly, the older Chinese industries to sort of just do more of what they were doing in China abroad. That whole initiative, I think, has had some troubles recently. They’ve got the same type of debt demands or demands for debt moratorium, things like that. They’re facing that just as the Western countries that have been lent a lot of money in the developing world.

Most of the developing world is clearly not going to be able to pay its debt and then the question is, what do you do about that? That question is just coming up. It’s like the moon just below the horizon, but you can see the somewhat frightening light already.

My take here is China doesn’t pull the rest of the world into a recovery this time. What always happens in such circumstances, and when you’re running way below world full employment, is everybody is competing with each other, you see a lot of beggar thy neighbor policies, tariffs, currency depreciations, which have been rampant in Asia, over in the last few months. I mean, the dollar tends to go up in all these crises because so much of the world’s money is in dollars. I mean, you got Japanese banks, European banks, everybody else making dollar loans and the folks they made them to in the developing world can’t pay him back. Their prices for their products are collapsing and they’re hit by the COVID crisis too, and can’t move. You’re going to need some international cooperative solutions out of this.

Paul Jay: We’re not likely to see that the way this is going.

Tom Ferguson: I’m not disagreeing. That’s why my example here. I’m sort of with the folks who think, if this thing goes on, it looks more like 1932-33 than it does 2010, 2011. Or in other words, I’m accepting your great depression scenario as quite likely.

Paul Jay: Let me add one thing to what I said about China. While I said China could do this, it’s not like I’m thinking they will do this because the Chinese, the Chinese billionaires don’t want to raise the level of wages of Chinese workers any more than the American billionaires want to do it with American wages.

Tom Ferguson: Something like half of all the goods exported from China are by American firms. Half of that trade surplus represents American firms’ trade surplus in disguise. They don’t seem to think through new deal discussions, as it were. They need a new deal. They don’t have it. I’ve had discussions with some of these folks. China is a complex case that demands a separate podcast in its own right, which I’m not, which I would not rush to volunteer for, but…

Paul Jay: Okay. Let, let me just ask you one question to sort of round things up. If we’re going into ’30s style deep depression, what are the lessons of that for today?

Tom Ferguson: All right. The lesson I’d say is this. This is an area I know very well because I’ve worked so long on the new deal and its period in the US and many other countries. What you saw in the great depression after the crash. You know, the depression started in Germany in 28. And then the October 29 crash, of course, is usually taken by a lot of people, mistakenly. It’s the sort of the beginning of that. Anyway, it spread around the world. In ’31, you saw a giant new downward leg because Europe collapsed. Peter Temin and I shared some years ago the famous story about how the Kreditanstalt failed, leading to a run in Germany, which led to a run in Britain, which is all not true.

The German government would not decide that they wanted out of reparations and decided not to pay and had a run on that. That whole Kreditanstalt story just did not have the effects that people said it did. It was internal politics in Germany that blew apart Europe at that point.

That kind of stuff is happening again in Europe in a completely different context there. But after the standstill agreement on European debts in 1931, the downward leg of the depression went down again. And then there was an effort to organize a big world economic conference in London. Now, most of the folks doing that London conference where the old thinking, doing old things. They probably would have failed anyway, but all hope for any kind of international cooperation went down the drain, and Franklin Roosevelt just got up in the US and said, okay, we have had it. We are going to just do recovery in one place. I’m not urging this as the optimal policy for the world. It’s not, but you’re probably gonna have to, as things get worse and worse. If you can’t get a reasonable solution in Europe and the Chinese are just not in a position to take one on now, without redistributing income, that’s not going to happen anymore in China, then it’s likely to happen in the US.

Paul Jay: Well, let’s go back to the politics of this. Let’s say Biden wins the election, and clearly, the only thing is a Rooseveltian New Deal, a Green New Deal, a massive expense, public expenditure and infrastructure, assuming people can go back to work, and if they can’t, massive stimulus directly until people can go back to work. But as you said earlier, the Democrats, as much as the Republicans, are beholden to finance and finance, ain’t gonna like that plan very much. So what would you expect from a Biden administration? And if they don’t step up, then what?

Tom Ferguson: If they don’t step up we will probably have some very fundamental political changes coming down the pipe. The Obama people basically blew their chance to remake the economy in a constructive fashion. You know, they did the half-size stimulus. And they got 2010 right out of that. That is to say, they immediately lost control of the house. If Biden fails to step up, you’ll see another swing back to the right.

Now the question is, what’s Biden going to do? It’s perfectly obvious that Biden is part of the Wall Street branch of the party that just basically detested not only Sanders, but Warren, and really didn’t want to deal with generalized medical care for all, if you like, single-payer insurance for people. Even though they love single-payer insurance for businesses and are now implementing it on a colossal scale.

This is going to be a problem. I’m not clear what happens next. I mean, the advisors to Biden are basically the Obama-Clinton types. Larry Summers is prominently mentioned. He’s not the only one. They probably learned a bit. They haven’t, I think, learned nearly enough. They’ll probably fail again. A lot is going to depend on what happens inside the Democratic Party.

It’s perfectly obvious that Pelosi, Schumer, and company, really don’t like the left-wing in the house, like AOC, for example, or other folks. And that the Democratic National Committee has done its best to exterminate challengers to business Democrats who would prefer to really just cooperate with Republicans.

At the end of 2014, early 2015, that was a thing that weakened Dodd-Frank. There was a provision in there that made it possible to greatly increase the amount of money falling into the Democratic and Republican national committees that had bipartisan support, as you might imagine. And an awful lot more money did come in. It was, I think the background for what happened in 2016, where the party just worked openly against Sanders. If you’re looking for an explanation of what’s happened in the early 2020 presidential race, in particular, how that sort of vast movement, from Virginia on down, across the South, got organized against Sanders, I would start looking there and the DNC. We are being strangled by political money. It’s not a lack of ideas.

We don’t need a bunch of technological sages telling us how to sort of do weird new schemes, or stuff that will make Silicon Valley even richer, as the solution to our problems. Our problem is that we are in a system of party competition in which both wings are dominated by plutocrats. It’s just big money.

Paul Jay: Well, thanks very much for joining us, Tom.

Tom Ferguson: All right, well, thank you for having me have a good one.

Paul Jay: And thank you for joining us on the analysis.news podcast.

Shared

When Thomas Ferguson questions why the unions are not involved in helping the workers, I have read about why this is happening in the World Socialist Website. They follow major unions (the auto unions are a good example) where unions are in coordination with the corporate powers and actually help the corporation force the workers into bad deals.

Example:

https://www.wsws.org/en/articles/2020/02/21/uaw1-f21.html

Michael Grimes, former top UAW administrative assistant, sentenced to 28 months for role in kickback scheme