Full Employment Will Overcome Neoliberalism & the COVID-19 Jobs Crisis

Robert Pollin advocates a macroeconomic agenda centered on full employment. The decades-long neoliberal attack on the working class is heightened with COVID-19. The world needs a New Deal to counter levels of unemployment and inequality last seen in the Great Depression.

ROBERT POLLIN: Isn’t it ironic that we have 15%-20% unemployment depending on how you measure it and the stock market is going up, not down. It went down, but then it came back up. It came back up because the Fed is keeping it up. So the Fed is defending capitalism really to an unprecedented degree.

LYNN FRIES: Hello and welcome. I’m Lynn Fries and that was Robert Pollin joining in this episode of Global Political Economy newsdocs. What would it take to move from COVID-19 lockdown to an abundance of decent jobs in all countries? Is it possible for a capitalist society to reach full employment and stay there? In this segment with Robert Pollin we get some perspective on all this and on why full employment is such a challenge to capitalist prerogatives and neoliberal logic.

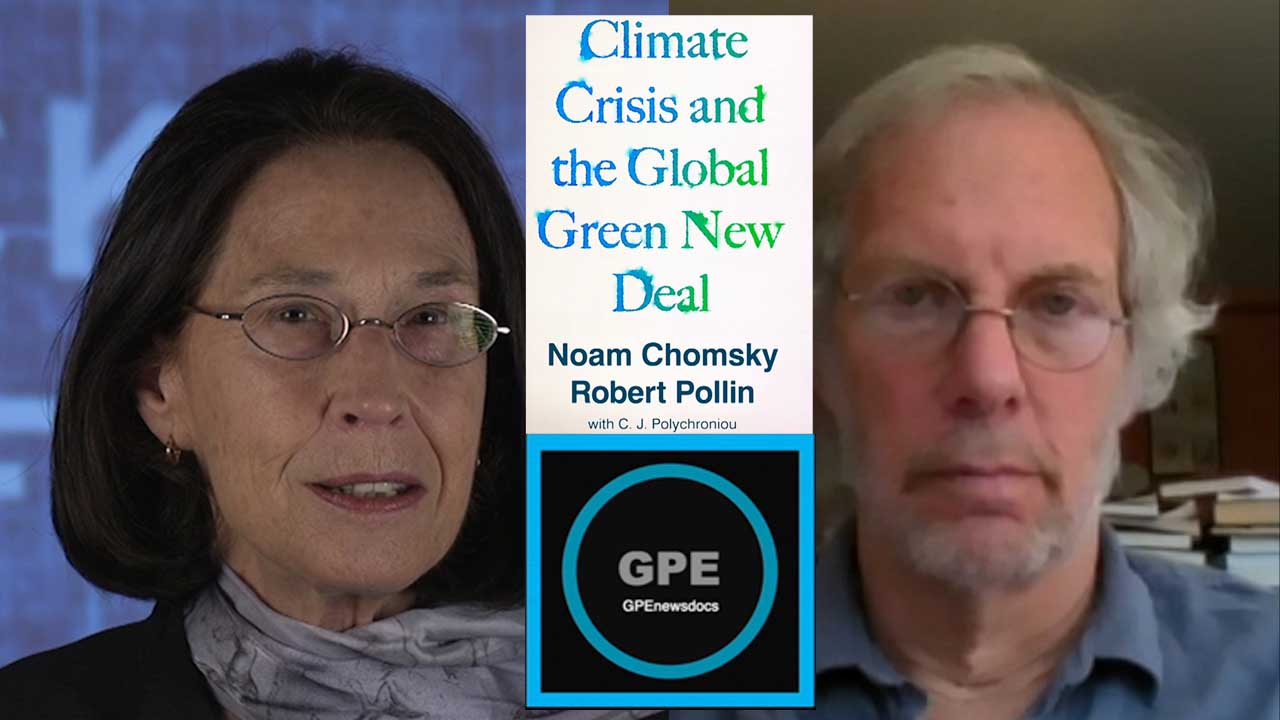

Robert Pollin is Professor of Economics and Co-Director of PERI, the Political Economy Research Institute, at the University of Massachusetts in Amherst. A prolific author, Robert Pollin’s upcoming new book is titled Climate Crisis and the Global Green New Deal, The Political Economy of Saving the Planet co-authored with Noam Chomsky. Welcome Bob.

POLLIN: Thank you.

FRIES: With the COVID-19 crisis unemployment is reaching levels last seen in the Great Depression. Your book Back to Full Employment delves into basic observations of Karl Marx, John Maynard Keynes, Michel Kalecki [pronounced Michael Kaletsky] and Milton Friedman as major thinkers on unemployment. Let’s start there. Give us a précis on that.

POLLIN: Karl Marx is widely considered to be the great thinker of socialism. Which he was but the fact is that Marx spent about 90% of his time – when he wrote about political economy – writing about the nature of capitalism. And in his discussions about capitalism one of his most fundamental insights, in my opinion at least, was his point that capitalism needs mass unemployment in order to function as capitalism. Not that you need mass unemployment in terms of the well-being of human beings but if we’re operating within a capitalist system, you have to have masses of people who are unemployed or else you can’t have a functioning capitalist system.

And his argument is straightforward. What he said was: In a full employment version of capitalism, workers will get more bargaining power. Why? Because if they don’t like their job, they can quit and just go get another job and they don’t have to worry because you have full employment. So, what Marx said is: you have to have that mass of unemployed people or what he called the reserve army of labor waiting outside the factory gate; waiting outside the office; waiting in the unemployment lines. And that because of that, that enables capitalists to maintain bargaining power over workers and to keep their wages down. If workers have more bargaining power, they bargain up their wages, that squeezes profits and capitalism without profits is impossibility. So that’s why Marx said mass unemployment is intrinsic to the operations of capitalism.

Now, if we move forward to some of the other major thinkers that you’ve listed, we have John Maynard Keynes I would argue as the next great theorist on unemployment. And Keynes critically was writing in the midst of the 1930s Great Depression. So thinking in terms of the 1930s Depression where we have 20%-25% unemployment rates, Keynes was making the argument that this was a massive policy mistake. That you could run capitalism without mass unemployment, certainly not with up to 20%-25% unemployment.

So Keynes said what we need to think about are policies that will bring the capitalist economy to full employment. And what he was referring to specifically were government policies to stimulate economic activity: to get businesses to invest more, to get people to spend more. And that way, the government would then be responsible for maintaining the higher level of activity. And with a higher level of overall economic activity, people have jobs. And so he was saying from a technical standpoint, we can certainly operate a capitalist economy at full employment and keep it at full employment as long as you have well-meaning intelligent policy makers who are hitting those targets of keeping the level of overall activity high.

Now, the third person you mentioned is Kalecki. And Kalecki is obviously nowhere near as well-known as Marx and Keynes who are probably two of the three or four most influential economists ever. But Kalecki had a very insightful approach. And he basically made the point that there is a lot of truth in both Marx and Keynes and his synthesis of them is what’s really critical. Because he said, Kalecki said: Okay. Keynes is right. Keynes made the point we have the economic policy tools and we have like really smart, intelligent people (sometimes) in government and it’s true they can raise the overall level of activity in the economy which will create more jobs. They can keep the economy at the high level of activity so you have full employment under capitalism. No problem, technically, he was right.

But then Kalecki said: Listen, Marx is also right. Because Marx’s point was not about the technical requirements for full employment, it was about the political requirements for full employment. And in fact, Kalecki’s famous paper is called Political Aspects of Full Employment. And so Kalecki said: Look, sure, we can get to full employment in following Keynes. But we still haven’t solved the problem that at full employment the workers are going to get more bargaining power; they will bargain up their wages; that will squeeze profits; capitalists won’t have profits to the extent that they want and that is going to undermine the viability of the capitalist system. So Kalecki had this brilliant synthesis of Marx and Keynes.

And then the last person that you mentioned, Milton Friedman, he comes at it from a very different tradition. But weirdly enough, his conclusions aren’t all that different than Marx believe it or not. Though he comes at it from a right wing neoliberal, I mean Milton Friedman pretty much defined neoliberalism. But basically Friedman’s argument is: Look in a capitalist economy you have competitive markets and people are competing; businesses are competing for customers; they’re competing to produce products that people want to buy. So any business worth its salt is going to hire workers; and as long as they need workers and they’re going to pay people what they’re worth, bargaining is going to end up paying everybody what they’re worth because otherwise you’d lose good employees; the other businesses will hire the good employees; pay them more; and so you can’t compete by just paying low wages.

This is what Friedman said. So what Friedman said is: If you just let the free market operate, you would be at full employment all the time. Everybody who wants a job would get a job. They would bargain with the individual businesses, capitalists. In the end, they would get paid what they’re worth. Because businesses have to pay you what you’re worth, or else you go and work someplace else. And so, he said: Look in capitalism, we have full employment naturally.

Now, then what he said is that: Okay? I know, I know, I know we don’t really have full employment. But he said the reason is that workers’ bargaining power causes the unemployment. Which is kind of what Marx came out and said, coming at it from a different angle. Friedman said the following: Take the idea of minimum wage laws, solet’s say we set the minimum wage at $15 an hour. Businesses say: These workers aren’t worth $15 an hour. Maybe they’re worth $10 but the law says I have to pay them $15. And I can’t pay them $15 because then I can’t make any money. So therefore these workers are going to be unemployed.

And what is causing unemployment, in this case, in the Friedman story? What’s causing it is the government intervention, presumably trying to help out the workers, ending up, making things worse for a lot of workers because even if a worker says: Okay, sure, I’ll work for $10 an hour, the law says you can’t do it. So you have all these people that are willing to work for $10 an hour, that can’t get jobs because the businesses don’t want to pay them $15. So that’s what Friedman called labor market rigidities.

And those rigidities like minimum wage laws and as Friedman also said unions perform the same function; unions give workers’ bargaining power, they do, they bargain up the wage. But Friedman says: Well, if you bargain up the wage then businesses are going to get forced to pay workers more than they’re worth and that won’t last. And so that according to Friedman is the basic cause of unemployment; that workers have too much bargaining power; that will cause unemployment. Ironically, Marx also said when workers have too much bargaining power, capitalism can’t work as capitalism.

FRIES: Keynes is known as the father of macroeconomics. Talk about that and about the most important purpose of macroeconomics at the time of Keynes. And then how the use and purpose of macroeconomics changed so dramatically from the late 1970s.

POLLIN: You know, of course, we had economics before the Great Depression and before Keynes. And as I said Marx really focused a lot on the problem of mass unemployment. But really it’s with Keynes’s book in 1936 during the Great Depression and in the aftermath of that, that we really start to focus on this and we have this field explicitly addressing the issues of the overall economy. So we come up with this term, macroeconomics. And really initially, macroeconomics had as its single most important purpose, initially, to achieve and sustain full employment under capitalism. That was the whole point.

And so the policy tools that were being refined and implemented were that the government should maintain the level of activity targeted at the level of activity that would be consistent with everybody who wanting a job, getting a job. So if the level of overall activity, what we call GDP, the level of overall activity was such that you had big, big numbers of unemployed, 7%, 8%, 9%, the government should basically spend more; create more jobs that way until you get to the full employment point. That’s government spending with government borrowing. So, it’s government deficit spending.

So you’re not taking out in terms of tax money; you’re just putting in, in terms of government spending and then the government pays off its debts later when you hit the full employment. The other big tool during this period of macro-policy was the central banks operating interest rates, influencing interest rates so if you have high unemployment, the central bank would lower the interest rates to the extent they could; and with low interest rates businesses are more likely to borrow money; consumers are more likely to borrow to buy a house or to buy a car and therefore that’s the other way through which you stimulate the economy and keep it at full employment. And that was the basic…that was it. Basically from coming out of World War II until the early 1970s that was the toolkit. Now countries did it to greater or lesser degrees. There were refinements but that was basically the model.

What happens in the 1970s is that you have this period of high inflation that was really unprecedented, certainly in peace time. Now the cause of the high inflation was the oil price shocks coming from the OPEC oil producing countries that realized they could get away with this. They raised oil prices 300% in 1973; and then again another 300% in 1979. Now that’s just one price, the price of oil; but that’s a very important price, the price of oil. So that really threw the capitalist, Western capitalist economies off-kilter.

Through let’s say the early 1970s, the rich high-income especially European economies were operating pretty close to full employment, you know, 2%, 1 ½% unemployment rates. They were succeeding in this kind of Keynesian model. It got completely overturned due to the oil price shock. And then the shift in focus in macro economic policy was really to worry about controlling inflation as opposed to maintaining full employment.

Now, it so happened that when that oil price shock led to inflation, you then also you returned to these people like Milton Friedman. Who said: See, we told you all along. Capitalism… if you give workers too much bargaining power, just like Marx said, if you give workers too much bargaining power, you’re going to have inflation and so that we need to drive down worker bargaining power. There’s too much strength in unions. There are too many regulations that support workers; like minimum wage laws and other forms of worker protection like unemployment insurance. And so this whole gigantic shift in the policy direction really started in the early ‘70s but maybe more moving into the late ‘70s and really got crystallized with the election of Margaret Thatcher in England in 1979 and Reagan in the United States in 1980 that were so aggressively anti-worker.

The way they posed it was to say: Well, we are really for, you know, inflation control; having an economy where we control inflation and we don’t have workers having so much bargaining power so that we can now learn to control inflation. And that’s that’s really what happened. And that really is the beginning of neoliberalism. That idea that macro policy should be used to attack the working class, not to maintain, sustain decent jobs at full employment.

FRIES: Let’s turn to the 1990s when neoliberal macroeconomic policy really took hold in both the developed and developing world. How do you explain that?

POLLIN: In my opinion, the consolidation of neoliberalism, of a policy regime in which we focus on inflation control over jobs; in which we deregulate the financial markets; in which we basically abandon equality within capitalism as a goal; in which the public sector is attacked and in which we embrace austerity as opposed to expanding the economy to create more opportunities even if it means government spending more – so that whole neoliberal package; it was around forever, I mean, yeah Milton Friedman, this is what he’d been talking about for decades; it was really however only when Democrats in the U S; you know Blairites in [UK] Labour; similarly in Germany the Social Democrats; they. embraced a somewhat more moderate version of this neoliberal package.

And that’s what gave it the consolidated force that it had. If the left parties, official left parties, like the Democrats in the U S had been a New Deal Party; a party fairly strongly committed to the well being of workers neoliberalism could never have been consolidated. It was when you got Clinton in there who was, you know, this brilliant slick talker, slick Willie that was the term. And he could talk about feeling people’s pain and all that and that he was the first black President because he was so cool and he played the saxophone.

So all of that really helped to create an image meanwhile, the reality was Clinton and the Democrats were doing the bidding of Wall Street, just like the Republicans had done. And the fact that it was being done by Democrats is what enabled it to come in full force. In 1998 the deregulation of the financial markets in the U S was signed by President Bill Clinton. So Clinton gets rid of the regulations. He’s a Democrat. This is a left-of-center party. Yeah. Let’s let Wall Street do whatever they want and you get the equivalent with Blair in the UK and Schroeder in West Germany and so forth.

So, really the neoliberal project becomes a unified project of mainstream parties. And the rise of inequality has proceeded a pace throughout the whole era of neoliberalism throughout Clinton throughout Bush one, Bush two, Obama; inequality in the United States has risen persistently throughout all of these periods.

FRIES: Taking a developing country experience so we get a developing country as well as a developed country perspective on all this give us some context on how this transformation of economic thinking throughout the world and most especially the global South was not simply a matter of ideological persuasion but that there was coercion involved. Take the case of South Africa as an example as you have extensive experience there.

POLLIN: What really is underlying this ideological transition is the fact that under neoliberalism the power of capital becomes overwhelming. So sure we have this, you know beautiful revolution in South Africa where we overturn apartheid. And Mandela, you know impossible to believe but Mandela, Nelson Mandela becomes President of South Africa; a man who spent 27 years in prison as a terrorist, so-called terrorist. So these were unbelievable historical achievements.

At the same time, once the African National Congress came to power, they made the decision that really they can’t do anything unless they have the approval of global capital. They cannot upset the apple cart because they won’t get any investments in; they won’t have any money to buy imports that they need. And therefore, they’re going to operate within the framework of capitalism as defined by neoliberal capitalism, as defined by Wall Street because they think that’s the only way they can really succeed; that’s the only path forward.

It’s very difficult to challenge that view. You have to have a strong analytic foundation that’s an alternative but you also have to be able to say that: Look, we have a political movement that is capable of challenging the prerogatives of capitalists. We can elect people to office that don’t accept the idea that rising inequality is a given and maybe even a good; we want more equality; we want more commitments to social investments, to healthcare, to childcare, to elder care that that’s our priority. And yes, we can have market operations within that framework but the commitment to general well-being is our foundation. And that really is the basic idea coming out of Karl Polanyi in his great work The Great Transformation which came out at roughly the same time as Kalecki’s work.

So these people Kalecki, Polyani, even Keynes are really people who experienced the Great Depression, World War II and are thinking deeply about how to build a decent society. And Polanyi said: Okay, markets are one thing but you have to have a foundation and solidarity or else you don’t have a society. You have a dog-eat-dog situation and so really the challenge coming out of Polanyi is what are the things we need to do to create a foundation of solidarity? That was really his challenge which by the way, is pretty much what you get out of a careful reading of Adam Smith way back in 1776.

People think of Adam Smith as the great expositor of free market capitalism. It’s not actually true. He did see a lot of virtues in markets especially relative to monarchy but he also made the point that we have to build a society with a moral foundation. In fact, the book he wrote prior to The Wealth of Nations in 1776 was called The Theory of Moral Sentiments. And as Adam Smith theorized, yeah we can have markets and markets can be competitive and people can be out for themselves but that needs to be within a framework of social solidarity.

FRIES: Bob, briefly recap the Marx problem, the Keynes problem and the Polyani problem in the era of neoliberalism.

POLLIN: Under neoliberalism, as we’ve discussed, you don’t have the commitment to full employment. So the Marx problem of mass unemployment being the fundamental regulator of the operations of the macro-economy emerges full force. Under neoliberalism, we eliminate financial regulations for the most part and that then leads to the emergence of the highly speculative bubbles, financial bubbles that then led to the 2007, 2008, 2009 Financial Crisis.

And what about the issues of social solidarity? Well, we certainly are seeing that all over the world. I mean the rise of neo- fascism is really a marker in terms of people basically deciding we don’t care about social solidarity; we have gotten kicked around by the big shots, the neoliberals, the politicians and some of them talk a good game; none of them deliver for us. We’ve seen this for 40 years and so we have to fight for ourselves and we don’t want immigrants; we don’t care about…we don’t want social institutions; we don’t want to pay taxes for that. So that’s really the three critical markers of neoliberalism.

FRIES: Let’s wrap up with your thoughts on the way forward in a world facing massive unemployment problem on the scale of the Great Depression and where it is technically possible to generate decent jobs in all countries if instead of neoliberal macroeconomic policy making that blames workers for inflation macroeconomic policy was used to create and sustain decent jobs at full employment.

POLLIN: Yeah. We’ve had 40 years in which the class strength of the capitalists has been absolutely predominant and you can see that through the figures on inequality. So that, you know, the level of inequality peaked in 1928 right before the Great Depression and the Wall Street crash where the top 1% got about 25% of all national income. Then that number after the Great Depression had collapsed, the top 1% had about 10% of national income, way less proportionally. And then with neoliberalism in the 1980s it started to rise again to where it basically got back to the top 1% having about 25% of national income.

The difference between now and the 1930s is that now it is still staying at 20%, you know, the top 1% still has 25% of national income; in the 1920s it was at that level of 25% and then collapsed. So the power of capital under neoliberalism has just been extraordinary; has been really historically unprecedented.

What I’m advocating is yes, a reversal back to something like a New Deal tradition. Something like the kinds of things that Bernie Sanders was talking about in his campaign. So, you know, Sanders calls himself a socialist but really the types of policies he was advocating were basically along the lines of a New Deal. And so that’s… you were nice enough at the outset of this interview to mention the new book which is called Climate Crisis and The Global Green New Deal. So in addition to the issues of inequality, obviously, we have to focus on the issue of the climate crisis and what to do about it. I see the notion of the Global Green New Deal as a way through which we can synthesize an egalitarian agenda and an ecological agenda.

FRIES: We have to leave it there. Robert Pollin thank you.

POLLIN: Thanks so much. It’s really been great talking with you, Lynn.

FRIES: And from Geneva Switzerland thank you for joining us in this episode of GPEnewsdocs.

Podcast: Play in new window | Download

Robert Pollin is Distinguished University Professor of Economics and Co-Director of the Political Economy Research Institute (PERI) at the University of Massachusetts-Amherst. He is also the founder and President of PEAR (Pollin Energy and Retrofits), an Amherst, MA-based green energy company operating throughout the United States. His books include The Living Wage: Building a Fair Economy (co-authored 1998); Contours of Descent: U.S. Economic Fractures and the Landscape of Global Austerity (2003); An Employment-Targeted Economic Program for South Africa (co-authored 2007); A Measure of Fairness: The Economics of Living Wages and Minimum Wages in the United States (co-authored 2008), Back to Full Employment (2012), Green Growth (2014), Global Green Growth (2015) and Greening the Global Economy (2015). His forthcoming book with Noam Chomsky is Climate Crisis and the Global Green New Deal: The Political Economy of Saving the Planet (2020).

Shared

Great to get bolstering facts and expositions of reasons from a wise voice for what you’ve learned of the system. And intuited. And an (optimistic) sense of where you can take that knowledge.