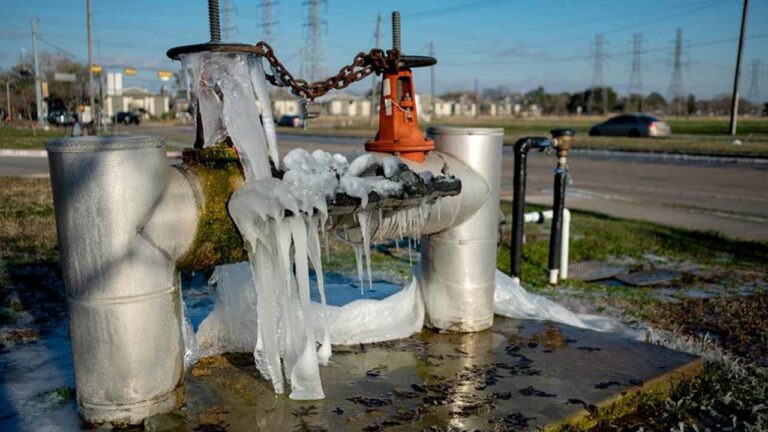

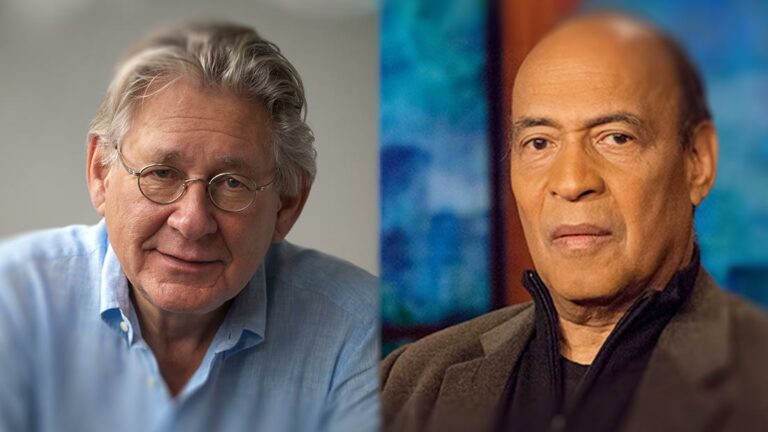

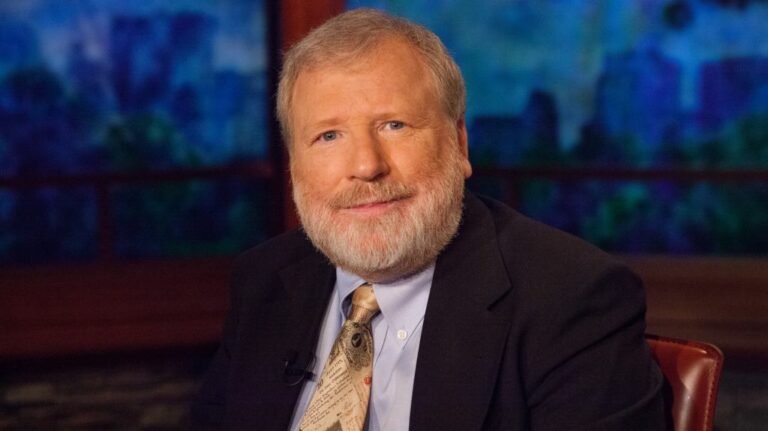

Biden Heads to COP 26 Throttled by Manchin and Trumpists – with Bob Pollin

It looks like there’s not much left of Biden’s climate legislation as he heads to Glasgow planning to lecture China and the world. What should he be doing about the climate crisis? Bob Pollin joins Paul Jay on theAnalysis.news.