Make the Fed Publicly Owned and the Foundation of a Public Banking System – Gerald Epstein

The Federal Reserve has been subsidizing the megabanks, but what’s needed is an institution that provides the backstop, the loan guarantees, the subsidies, the lines of credit, et cetera, to support the development of a whole variety of public financial institutions. Gerald Epstein on theanalysis.news podcast with Paul Jay.

Transcript

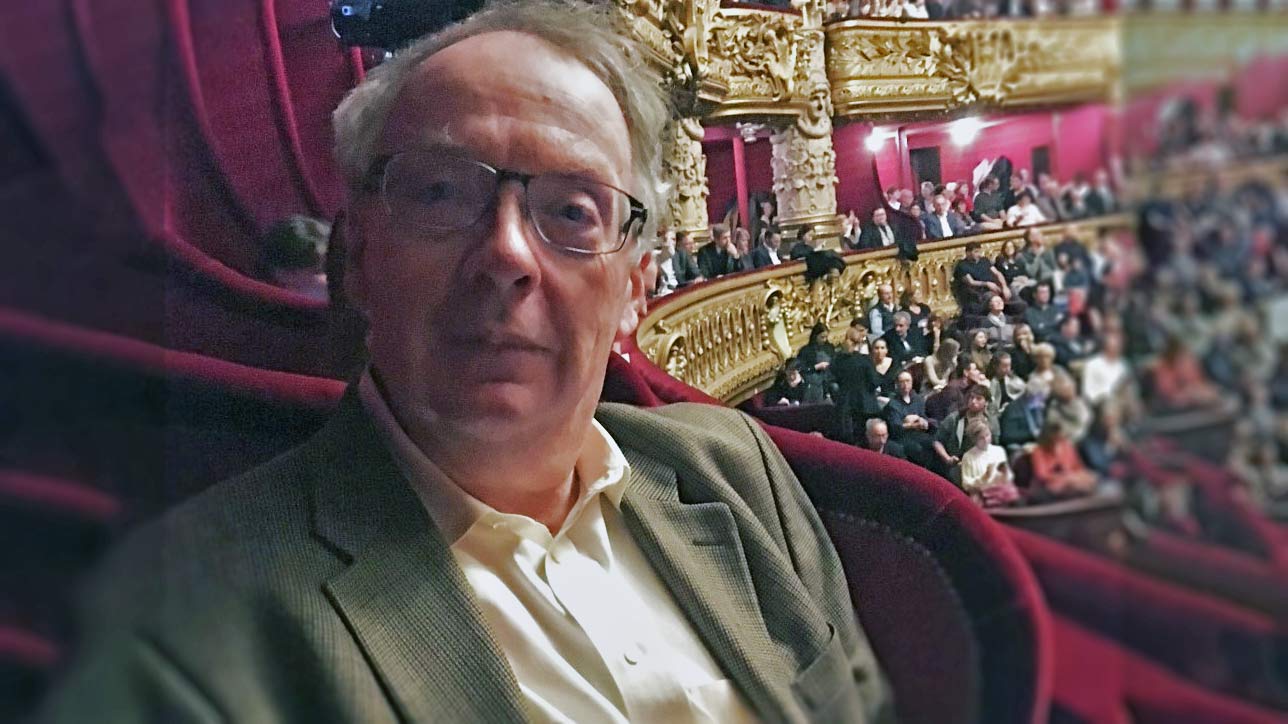

Paul Jay

Hi, I’m Paul Jay, and welcome to theAnalysis.news podcast.

As the economic crisis deepens, many states are having a resurgence of the COVID pandemic and we’ll soon probably be closing down again, those were mostly states that open too early, but it does not look like a quick fix to the recession, nor is there going to be a quick opening in a broad way of the economy or a quick lessening of the millions of people who are unemployed. The Fed has shown, however, that when it needed to, it could come up with a lot of money.

It’s committed to about four trillion dollars of stimulus in one way or the other. I say one way or the other because there’s a chunk of this money is being spent to defend the assets of wealthy people to prop up the stock market. Some of it is being spent to help subsidize going towards the federal government, being capable of adding to the unemployment insurance and other kinds of direct plaint payments to workers and small business loans and such, but a large part of the money is going to prop up the value of assets, and rich people have more assets than non-rich people.

At any rate, if there’s going to be a change and if there’s a Biden presidency and there’s any political will to have real reform, that reform is going to have to maybe even start with the Fed and what its role is because the Fed has the ability to finance programs of all types. And the question is; is this Fed going to be funding programs that actually benefit the broad population or continue to socially prop up assets of the wealthy?

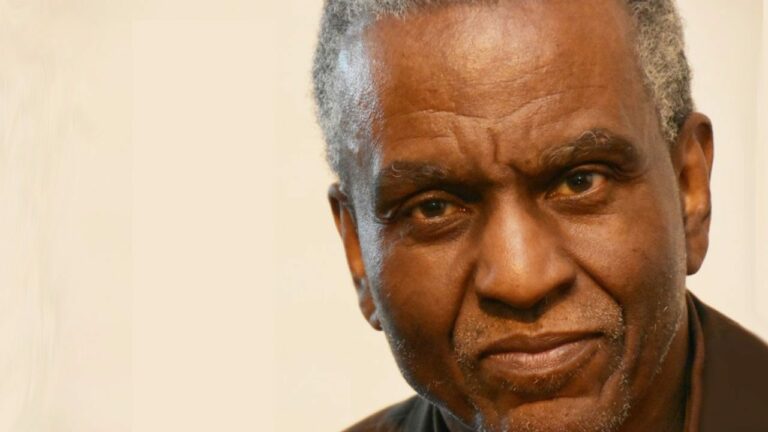

So now joining us to discuss this is Gerald Epstein. He’s a professor of economics and co-director of Political Economy Research Institute, Perry, at the University of Massachusetts, Amherst. His recent book is Political Economy, Central Banking, Contested Control and the Power of Finance. Thanks for joining us, Jerry.

Gerald Epstein

Thanks for having me, Paul.

Paul Jay

So I would like to have a bit of a blue sky day, as they call it, discussion, meaning what could one do with the Fed if there was a real progressive government with a progressive mass movement to support it? And of course, it’s going to run into in the title of your book, ‘The Real Power of Finance’, which is considerable. But first of all, let’s just start with, for people that don’t have a handle on how and why we have a Fed, why do we have a central bank that is so controlled by private bankers?

Gerald Epstein

Well, their central banks in most countries around the world and the history of central banks is that most of them started off as private banks, the Bank of England, the Federal Reserve, other banks. But most of these private banks, central banks, evolved and were taken over by the government. And at that point, the private banks lost formal control over the central bank. The Federal Reserve, however, is different in that the private banks have continued to have a formal role as being members of the boards of directors of the regional Federal Reserve banks, which there are well, and the reserve has a lot of influence by bankers informally, where bankers play a very important role in helping to frame what the Federal Reserve does, there’s a revolving door between Federal Reserve officials and Wall Street.

This is true to some extent of most central banks, but it’s extreme in the case of the United States, now, I should say the Bank of England as well. Now it’s time to get the banks out of the Federal Reserve and make the Federal Reserve a nonbank public institution.

Paul Jay

Because there’s a lot of talk, especially on theAnalysis.news and other places about the need for public banking. Well, it’s kind of crazy that the most powerful bank in the country really is the Fed. And it really should be a public bank with a public interest mission, not a stock market interest mission. But as long as the Fed is more or less controlled by people who are all connected to asset management and stock markets, how is it going to play any other role but to make that its priority? So what would it take to make the Fed a real public central bank?

Gerald Epstein

Well, before we go there, let me just say I think these two crises we’ve had back to back, the great financial crisis of 2007-2009, and now the fallout from the Corona crisis has made the point very clear. Mainly in both cases, the Federal Reserve was confronted with a real crisis for the whole economy, for workers, for homeowners, for states and locales, and so forth. But in both cases, and it’s become increasingly clear this case, that the Fed has primarily bailed out the wealthy by propping up asset prices, the stock market lending money and corporations buying corporate bonds.

So they created a lot of facilities to buy assets and make loans. And most of these benefited the wealthy and the banks and the corporations. For the first time, though, they also created these facilities from pressure from the Congress to help out workers and state and local finances, as in medium-sized businesses and small businesses. But these facilities have been so poorly constructed that the Federal Reserve has given very little in the way of loans to state and locales and others. So most of the support that the Fed has given to Wall Street. And that’s just because that’s their natural operating procedure. It’s been that way for decades and it’s because of this nexus that we just talked about between Wall Street and the Fed and that has to change.

Paul Jay

And we’ve done some stories about this, but I think it’s important to make the point again. They’re propping up the stock market. I mean, it’s like a ridiculous situation, millions of people unemployed, the real economy was at a halt and still, to a large extent at a halt. You know, by all normal reckoning, the stock market should be tanking, except it’s back to historic highs. It’s insane. And that’s because of what the Feds do.

Gerald Epstein

That’s right. The Fed is buying financial assets, pledging to keep interest rates low indefinitely. And that’s a natural boon to people own financial assets where instead of that, it should be lending directly to those that need it, small businesses, states and locales of workers and nonprofits. And even though the Federal Reserve set up some facilities, that’s made some initial steps toward doing that. They created in such a way that it’s so costly for people to borrow from that, that’s nothing new.

Paul Jay

Yeah. Let’s talk a bit about this. They’ve committed like four trillion dollars of various kinds of stimulus money in because of the pandemic. But what is it? Something less than a trillion has gone out the door. What’s going on here?

Gerald Epstein

Well, let me give you an example of something that I’ve been working on quite closely. As you know, states and locales are in terrible trouble. The ideal way to help that would be for the government to give grants to states and localities to help fund education, their health care systems, et cetera. But the government isn’t doing that. Congress has passed the Heroes Act, first the Carers Act, and then the Heroes Act, but the Senate hasn’t picked up the Heroes.

So the Federal Reserve created this facility to lend to municipalities and state governments. It’s called the MLS, the Municipal Liquidity Facility. It can lend up to five hundred billion dollars to states and locales to fund their activities. But they set the interest rate so high and the term so short that it’s only three years that only one state, Illinois, has borrowed from it. So they have five hundred billion dollars capacity to lend and only about a billion or two has gone out the door because the Fed is just uncomfortable with lending to the people. It’s uncomfortable with lending to the real economy. It’s mostly comfortable with lending to Wall Street.

Paul Jay

OK, so let’s start to imagine that there is this movement in the streets, that’s able to get back on the streets and if not online in a big way, let’s imagine, this is not a big stretch, Biden does get elected. And if the election was today, I don’t think there’s any doubt he would be, but let’s see what happens by November. If not, assuming Biden still with us and assuming Trump still with us, then who knows what shenanigans Trump has in mind. But let’s assume things take their course. What would a progressive’s demand if Biden created these committees with Sanders, (Bernie Sanders), to come up with different kinds of proposals in different areas? Interestingly enough, not a single joint team on foreign policy, but that’s a different question. But when you get to the question of finance, the financial sector, the power of finance, and specifically the Fed. What what would your recommendations be? And let’s just assume the best.

Gerald Epstein

So there are at least two broad aspects to this. One is financial regulation. And one is transforming the financial system, including the Fed. Interestingly, out of these two crises that we’ve had, there been some colonels of genuine reform that have come out of both of those that have been stifled or ignored, but could be built upon. So, for example, after the great financial crisis, the Dodd-Frank Act, there was a lot of discussion in the process of that that actually would have been very important to do.

One is breaking up the big banks, putting on asset caps or something like that, getting rid of derivatives and other things or regulating derivatives and other kinds of risky assets. Now, regulating the shadow banking system, including the asset managers, which I know you’ve been talking about all day, all of these things were proposed in the Dodd-Frank discussion. A couple of them were implemented, were released, put in the bill, but they were never implemented. And now it’s been ignored. But there’s a lot of discussion that came out of Dodd-Frank that could be implemented, that would be a big help, including primarily breaking up the big banks and getting the shadow banking under control.

Paul Jay

But the problem with breaking up the big banks is that these smaller banks that are left, aren’t they still more or less in the control, the same pools of capital? And as we saw from telecom when they were broken up over time, they can all get back together again. Isn’t there a need for real public banking on a large scale to counter that power? I certainly wouldn’t argue against breaking up the big banks, but I don’t see how that on its own deals with it.

Gerald Epstein

Yeah, no, I agree with you. So in order to sustain that and to make sure that the financial sector operates in the interests of the people, we do need a significant public banking sector. And in order to get a public banking sector, we need some centralized infrastructure to support and subsidize and help develop this public banking sector. And that’s where our discussion that leads to our discussion of the Federal Reserve. But the Federal Reserve has been doing is subsidizing and supporting for decades the megabanks and the private bank. But what we need is an institution that could be the Federal Reserve, it could be another institution, whose job is to provide the backstop, the loan guarantees, the subsidies, the lines of credit, et cetera, to support the development of a whole variety of public financial institutions. Financial institutions at the local level, at the regional level, financial institutions, nationally, for example, a green bank or a set of green banks to help finance the green new deal.

So these banks cannot sprout up on their own. They need an infrastructure created by the federal government and the Federal Reserve isn’t the right institution to do that. They need to create a bankers bank, bankers’ financial institutions to underwrite all of these institutions. So I completely agree with you. We have to break up the large banks and we have to build a network of a variety of public banks that are supported by the federal government.

Paul Jay

And what do you do with these big asset managers like BlackRock and Vanguard? You know, they claim they’re passive investors, but I think the evidence is that they’re more than passive. They say even on their own Web site, BlackRock says they engage informally with the management of companies. We know they control the votes, essentially control the voting about 96% of the S&P 500, and they’ve become the real behemoths of Wall Street. I think they’re up around, what, somewhere between 14 and 17 trillion dollars. Now, I’m not sure after the COVID closing and where they are exactly, but they have more wealth to the GDP of China. How does the Fed relate to the power of them? They claim, as I say, that they don’t get involved, but they do. And the concentration of ownership is beyond most people’s imagining.

Gerald Epstein

Yeah. So there are a couple of things here. One is there never were adequate regulations put in for the nonbank financial institutions like the asset managers, private equity firms, hedge funds, etc., that was completely left out of the Dodd-Frank bill. There were discussions about doing it. So for one thing, you need a regulatory umbrella for all these institutions, including the asset managers. But then there needs to be a specific anti-trust orientation towards the way the government deals with these behemoths that help to concentrate power. And so there has to be a regulatory but then an anti-trust element to that it’s implemented. And I don’t think the Fed is necessarily the right institution to do both of those, but we do need both of those to happen.

In terms the Federal Reserve itself, again, there are lessons that we can draw from the most recent crisis and the ways in which the Federal Reserve has been pushed by the Congress, by progressives in the Congress to do more, to help out Main Street, to help out state and local governments, to stop its singular focus on Wall Street and start helping out others.

There’s two things about this. One is that it shows that this whole fetish of having the Federal Reserve be, quote-unquote, independent, and is no longer politically independent, is no longer feasible if it ever was. In fact, that sort of reserve was never independent of Wall Street, it was just independent of the democratic process. But now with the crises, the two crises, it’s clear that the Federal Reserve has to be part of the overall government apparatus that revives the economy and that allocates resources to where they need to go. And this includes, as I talked about earlier, the Green New Deal, public banking, dealing with the huge racial disparities that we have in our country. And what this means is that the Federal Reserve its policies have to be integrated clearly into the government.

Now, one way to do that, without risking a total centralization of the Fed, which I think is dangerous, is to build on the regional Federal Reserve structure that was created in 1913. That is, we had these 12 regional reserve banks and these regional reserve banks can play an important role in managing credit policies in their districts, in having more Democratic membership of the regional reserve banks. It can become a very decentralized system where that’s better, where it’s more democratic. And, of course, there are still will have to be the centralized component of it in the board of governors in Washington, where it’s integrated into the goals of the administration.

Paul Jay

So in your model, how does the Board of Governors get selected, should it be elected?

Gerald Epstein

I don’t think it should be elected. What we need to do is make sure that the Board of governors, is that there’s a real selection process by the president and by the Congress that has a slate of candidates that is broadly representative of people, of the unions, of racial minorities and so forth. That has to be written explicitly into an amendment to the bylaws of the Federal Reserve there has to be a more representative society as a whole, just as there are designations like that in the designation of the boards of the regional reserve banks. And that has to be true of the Board of Governors as well. This is very important in terms of the integration of the Federal Reserve into the overall fiscal policy, because following the crisis, if we ever get out of this, there’s going to be a very large budget deficit among both the Democrats and the Republicans are going to call for raising taxes, cutting government spending and so forth. It has to be very clear that the central bank can continue to finance significant deficits up to a significant degree. I don’t think it’s unlimited the way some do, but it’s certainly up to a significant degree so that we can get out of this Corona crisis without falling back into this austerity the way that happened after the great financial crisis.

Paul Jay

What do you think the limits are?

Gerald Epstein

I think the problem is we don’t know what they are. We know some of the characteristics of things that would generate limits. We know that if the United States government keeps flouting international norms, cutting off international diplomacy, cutting off our trade and financial relations with the rest of the world, that the international role of the dollar, which is really the linchpin of the United States being able to borrow extensively in the open markets. If all that continues to the road the way it has under President Trump, then that makes it much more likely that some other currency like the Chinese yuan, the euro, or some other currency will really come up and seriously rival the dollar. And in a serious multi-currency kind of system, I don’t think these are going to replace the dollar. But in a serious multi-currency system, then the ability to borrow internationally, indefinitely, is called into question. And once it’s called into question, then that generates fears and risks and so forth so that it’s much easier for investors to dump the dollar if they think the deficit is getting too large, etc. It just becomes much more difficult to manage the economy with a massive deficit. So I think in some ways that are the major constraint on the ability of the United States to continue running this game here.

Paul Jay

So it’s essentially a confidence game. As long as people think the American dollar is credible, then it is. But if they start doubting it, then then it isn’t.

Gerald Epstein

Yeah, I think that’s what it amounts to pretty much.

Paul Jay

I saw an interesting study by the Brookings Institute from a couple of years ago, and they calculated the total amount of assets in private hands, meaning wealth minus liabilities. I can’t remember the exact number of the total amount of wealth. But then they divided it by the population of the United States and there was enough wealth to pay if they divided up all the actual assets to every individual over three hundred thousand dollars per person, meaning a family of four would get, you know, over a million dollars.

So there’s a lot of actual wealth backing up this investment, the stimulus. I would assume if there’s any objective measure of how much debt there can be. It has something to do with what the aggregate of wealth in the country, because in theory, at least, the state could if it had to tax some of this wealth back. Does that enter into how people envision why and how far this spending can go?

Gerald Epstein

Sure, and you’re right that the wealth levy, a wealth tax, if it came to that, this took place in some countries after the Second World War, as has been recommended for Italy, was its deficits, its debts running so high, etc. That is certainly one possible way to deal with this problem, were to come to ahead. So there’s no question that the United States has a lot of capacity to run deficits. And part of it is what I was talking about, part of it is the wealth. So then part of it is the fact that a lot of the borrowing that the United States engages in is from U.S. citizens themselves it’s not from foreigners at all.

Paul Jay

So, you know, the majority is that, isn’t it? I didn’t interview with Mark Blyth the other day and he was saying that too. When you see this debt, you have to realize that for the other flip side of that is that its savings for most Americans, mostly wealthy Americans. But still, it’s not like it has left the shores.

Gerald Epstein

That’s right, so that debt is a lot of flexibility as well. But it’s at the margin that it’s the foreign debt. And we economists are fond of talking about what happens at the margin if the foreigners if the Chinese start dumping American debt, then is that going to really change the exchange rate and the interest rates in such a way that it would cause a problem? I’m not expecting that scenario, I’m just saying it’s comforting that a lot of it is owned by Americans. But a lot of it also is owned by foreigners.

So anyway, the point is, I think right now most economists agree that the United States, given our wealth, given our dollar, et cetera, has a huge capacity to borrow. And it’s really important that the politicians and the Federal Reserve are on board. Once the Biden administration was to come in power, not to impose an austerity kind of policy, it would be a terrible mistake, that’s what happened to Obama and many other center-left or center governments around the world, and it would just be a disaster.

Paul Jay

Let’s go to something concrete that the Fed could do now without major reform of its structure. You have a proposal for what you’re calling human capital bonds. How does that work?

Gerald Epstein

So this relates to what I was talking about earlier. States and locales are in terrible financial situations, and this includes the funding of schools. You know, Trump keeps talking about opening the school, open the schools. A lot of state governments don’t have the money to pay teachers. And the reason why states are in such terrible financial shape is tax revenues have fallen through the floor. And, of course, there’s extra expenses associated with virtually all these state government activities.

Now, the first choice would be, as I said, to have the federal government give large grants. Some people estimated we need 500 billion, others a trillion dollars at the states and locales to fund public services, including education. But short of that, the Federal Reserve has the capacity and has already facilities set up that could wind up to five hundred billion dollars to fund activities like education. The problem is that most states have balanced budget laws.

That is, they have to have a balanced budget when it comes to current expenditures like salaries and so forth. They’re allowed to have a capital budget. However, for building to build buildings and roads and bridges, etc., things that are of longer gestation. So even if the Federal Reserve did open the spigot and was willing to lend to states, could the states borrow could pay for teacher salaries, salaries, agendas and schools, et cetera. And most states would be very constrained in their ability to do that because their current expenditures.

So my proposal is, states should be allowed to issue human capital bonds for current educational expenditures. Understanding that investing in the education of our young people is one of the most important and most productive long term investments that there is. And it’s kind of a misnomer to think of this as current expenditure for teacher salaries, et cetera. This is the type of infrastructure investment, and this would help states, I think, be able to borrow the longer term to fund current expenses in education, especially during the crisis, without having their credit ratings reduced or impaired.

So I’ve been working with some Massachusetts legislators and some others to see if there’s any interest in this idea, we can push it forward.

Paul Jay

But they’re going to have to do something like this because the states and the cities are going into a catastrophic financial situation. There is not going to be money to pay firemen and policemen and teachers and so on without some kind of massive federal help.

Gerald Epstein

That’s right and maybe Mitch McConnell will realize that and Congress will do what it should do, which is actually give this money to the states. But there’s a second track to move along as a backup for that kind of support, and especially certainly if it doesn’t come through.

Paul Jay

Maybe this becomes what some of the far-right ideologues, which includes some of the billionaires behind Trump, but others have wanted, which is the destruction of government and they’re going to wind up getting it at the state and local level at anywhere.

Gerald Epstein

Well, they probably have mixed views. They want to destroy it. As you know, they have for many years. They want to destroy the unions and all public and social services. They wanted to privatize education as much as possible. But they’ve always wanted to leave the people they could perceive to be harder to educate or poor people or minorities to the taking over by the state. And there has to be, at least even from their perspective, some minimal funds don’t educate the rest of the people. It’s a horrible vision, but that’s probably division that they have.

Paul Jay

All right. Thanks very much for joining us, Jerry.

Gerald Epstein

Okay, thank you, Paul.

Paul Jay

And thank you for joining us on theAnalysis.news podcast.

Podcast: Play in new window | Download

During the second world war, we, in the U.K. were issued with ration books, to ensure every citizen received a fair basic supply, of all necessities; well, that is exactly what a guaranteed “Basic Income” would do. So long as any “Basic Income” is spent into circulation immediately, there could not be any meaningful objection to it, and it would not create “inflation”, more precisely expressed as increased prices. Those who have plenty of money, i.e. more than their fair share, raise all manner of objections and fear mongering, and all of it is just self serving twaddle. Money, printed, issued, spent into circulation, and controlled by Government agency, would be the perfect solution to solve most of the Worlds social problems. Spend some time, and “search”, understand which “group” in our Society is controlling all money, then you will understand the ulterior motives behind this denial of “Printed” money.

All Governments and Nations of the world must take back their Sovereign rights that enable them to create their own supply of domestic, Interest free, Debt free, Social Capital; American State North Dakota still does this and they are free of the financial woes depressing the rest. The creation of money and credit must be returned to our Democratic Parliament; Private Banks, Corporations and Financial Institutions, must not control this important economic function.

This first step eliminates untold quanta of inflation (rising prices)and Government debt.

Every Sovereign independent Nation, or co-operating group of Nations, will then use this Social Capital to totally eliminate Poverty and deprivation in their communities by issuing to all that need it a Social Wage, structured to provide a basic break even living standard, a wage that will continue until death. The first duty of Government is to take care of it’s population; A Government controlled and issued Social Wage is the only way to successfully do it.

The Government will finance all conceivable Public Support and Infrastructures, Health, Housing, Education, etc.

The Capital so created will be the sole means of financing the Nations Money Supply. This will become a “trickle Up” economy, replacing the nonsense and fraud of trickle down.

No Capital or subsidy will go to Private Enterprise directly, for if it did it would cause serious inflation (in both currency and rising prices). Capital created, issued, and “spent” directly into circulation, as described above, would not create inflation (rising prices).

There would be no interference with Private Free Enterprise. The Private Sector could employ those in receipt of the Social Wage by offering wages, conditions, and hours of employment capable of inducing people to do the work offered; the wage so earned would supplement the Social Wage, not replace it. Thus inducing mutually agreed working conditions at much lower wage costs to employers. This will create a community of independent wage earners , no longer working as wage slaves, always in fear of job loss and penury. Will this not negate the export of jobs to China etc.?

Thus far no or very little taxpayer money has been expended. The burden of support for the poor and the provision of social and community infrastructure has been lifted from the backs of Corporate enterprise and the wealthy.

Control of Social provision has passed out of the hands of those not willing to vote for higher taxation to facilitate it. Working people are no longer at the total mercy of Market forces, that all too often deprive them of livelihood and take away hard won assets such as homes and pension funds. Working people can more easily change employment to escape unsatisfactory masters and conditions.

Price and cost inflation will be substantially reduced by ceasing tax collections from wage and salary earners. Instead individuals will pay tax only once, and that when they are deceased, when the taxman will be empowered to asses deceased estates for tax liability. Avoidance will place the whole estate in danger of confiscation. Is there a better time to pay tax other than when we are dead?

Corporations and all other commercial enterprise will pay an annual flat rate tax levied against total net profits. Avoidance, Tax Havens, and imaginative minimisation schemes will not be allowed. Tax allowances will be strictly limited to running,overheads and development expenditures.

Government will not subsidise free enterprise, this great engine, by it’s own rules, must stand or fall on it’s own merits, utilising it’s own Capital, raised through the “Markets”.

The value of Sovereign currencies for international purposes will be decided by co-operating Governments, taking into account the requirements concomitant with considerations related to employment levels and relative standards of living between co-operating Nations, and by Supply and Demand balancing. Exchange rates will be fixed, stable, out of the influences of manipulators and traders, and other market manipulators.

There is much more to be said in explanation, however your own knowledge and experience will enable you to foresee the many attributes such a system delivers. My title for it is “THE UNIVERSAL ECONOMY” for it will work anywhere and for every person, fairly and equitably.

A very small “coterie” of Bankers and money power people is holding the world to ransom, they spend untold quanta of money spreading lies about the evils of Social Capital, and the “Printing” of money, for their own narrow self interested purposes; populations around the world are in mortal danger because they are at mercy and threat of money lenders and commodity traders, or dire poverty, somehow the money power must be diluted.This dilution will come about when we elect independent politicians who will stop our representative system from being dominated by Corporate and private billionaire funding, intended to create and bend the World to their selfish undemocratic intentions; often requiring many death sacrifices, violent destructive War, resource theft , and all without regard for human-rights and the general well-being of innocent civilian populations. We need to change our system from being “representative” to being one of “participatory”; and return the Economy to one operating on sound money. This formula, most importantly,takes care of the constantly increasing costs due to population growth and other demographics.

Have you read this far? then you have my thanks, your commentary would also be most appreciated.

During the second world war, we, in the U.K. were issued with ration books, to ensure every citizen received a fair basic supply, of all necessities; well, that is exactly what a guaranteed “Basic Income” would do. So long as any “Basic Income” is spent into circulation immediately, there could not be any meaningful objection to it, and it would not create “inflation”, more precisely expressed as increased prices. Those who have plenty of money, i.e. more than their fair share, raise all manner of objections and fear mongering, and all of it is just self serving twaddle. Money, printed, issued, spent into circulation, and controlled by Government agency, would be the perfect solution to solve most of the Worlds social problems. Spend some time, and “search”, understand which “group” in our Society is controlling all money, then you will understand the ulterior motives behind this denial of “Printed” money.

Money can be whatever an independent Sovereign Nation says it is; all money printed and issued on our Planet is “Fiat” money; in other words, a bit of paper bearing a “Promise To Pay”, it is not rocket sceince.