Corruption in Lebanon Propped up by the Transnational Capitalist Elite – Nadim Houry

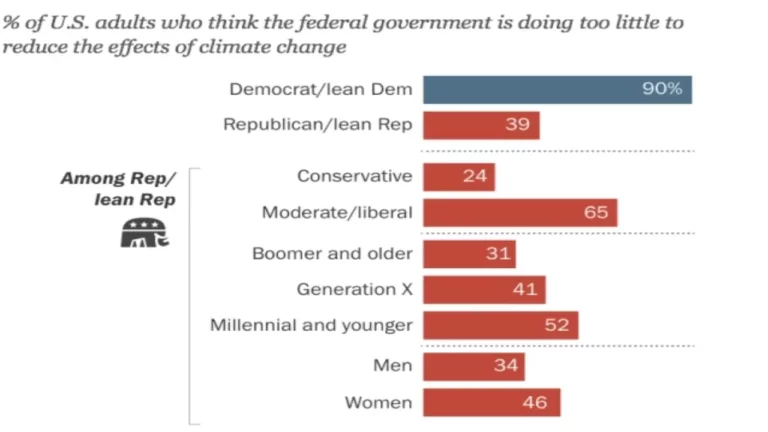

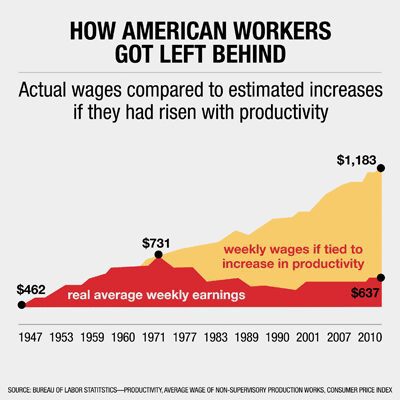

Widespread corruption in Lebanon is fostered by the country’s ruling class, whose business interests are enmeshed with those of international finance. Nadim Houry, executive director of the Arab Reform Initiative, explains how Lebanon’s culture of political impunity is tied to the reconstruction agreements put in place in 1990, at the end of the 15-year civil war. The ongoing political deadlock shields the authorities from scrutiny and allows for vulture capitalists such as the former governor of Lebanon’s Central Bank, Riad Salameh, to embezzle the country’s resources. At the same time, ordinary people are faced with crushing inflation.